Here is a lesson for those of you who think that the interest rate level is always the key to controlling foreign exchange rates.

Argentina’s currency crisis deepened today as an emergency interest-rate increase to 60 percent failed

to stop the collapse of the currency.

The peso extended losses after the central bank raised its benchmark measure by 15 percentage points to a global high. The hike was the second this month.

The peso was down about 12 percent against the dollar in trading earlier today.

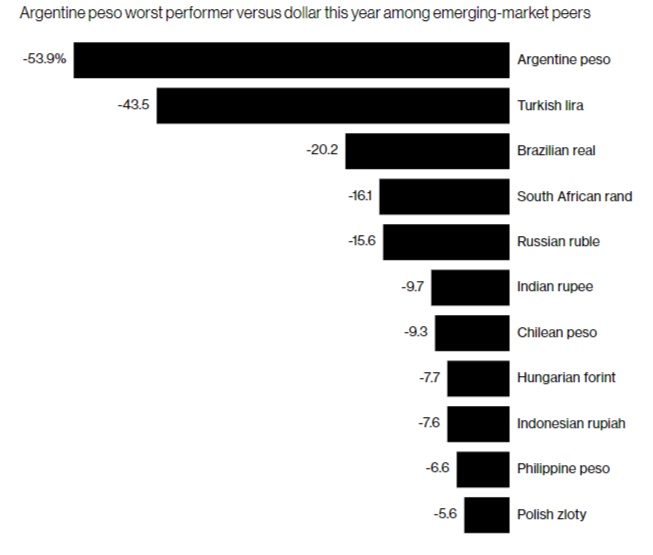

Year-to-date, the peso is down 53.9%

|

| Chart via Bloomberg |

The high interest rate is the result of rampant price inflation which is the result of extreme levels of money printing by Argentina's central bank.

-

Robert Wenzel is Editor & Publisher of

Robert Wenzel is Editor & Publisher of

Bloomberg's chart should include Iran's Rial

ReplyDelete