Email | Twitter

Exchange Traded Funds (ETFs) have become as ubiquitous to investor portfolios, including retirement accounts, as their cousins in the mainstay mutual fund universe. Yet, few are apprised of the differences between these two asset classes. ETFs often have lower costs, are more tax efficient, and can be shorted (much to the delight of Mr. Chanos), while mutual funds may offer greater investor protections under the Investment Company Act of 1940. The latter is a subtle point worth exploring because, as the the half life for the next Fed-induced bubble happily converges with the six month mark on Mr. Bernanke's QE3, these things never matter...until they do (which is when the inevitable Fed brakes foment a crisis).

With the help of the host and producers at RT Network's Capital Account, we will explore just what can (and if one believes in such platitudes as Murphy's Law, will) go wrong when the next BearStearnsLehman cluster occurs, with particular attention to the world's largest gold ETF, GLD (thanks to Ms. Lyster) and the world's "safest" U.S. long bond ETF, TLT.

From Lauren Lyster at Capital Account:

Time now for Word of the Day where we break down a financial term for our smart viewer but maybe not the financial expert. Today it's ETF or Exchange-Traded Fund. By attracting those looking to invest in nontraditional assets and sectors, the global ETF market has inflated to more than a trillion dollars in assets over the past few years...some put that number now at about 2 trillion dollars. David Kotok wrote a book on ETFs and spoke about them on our show recently. However, Kotok warns that investors should conduct serious research before purchasing shares in an ETF. We'll explain why shortly, but first, what exactly is an Exchange-Traded Fund (ETF)? Here's our definition:

Here (at the 2:30 mark), it's worth viewing "internationally acclaimed financial expert," Suze Orman play down (if not completely misrepresent) the virtues of owning physical gold. Contrary to the guru's advice, no: not all physical gold must be re-assayed prior to sale (if one sticks to smaller, well known coins and is not buying from this guy).ETFs are a portfolio or basket of securities, which provide diversification like mutual funds, yet are unique in that they trade on an exchange just like a common company stock. They usually track an index, either holding the underlying stocks of the index or using derivatives to achieve the same returns as the index. And since an ETF is designed to track a specific market index, one can play an entire sector without being forced to stomach the volatility inherent in any one stock.For instance, investors can gain exposure to precious metals using ETFs. Specifically, Gold and gold miner ETFs have become increasingly popular. But if you buy shares in a gold ETF like the GLD for example, the largest gold ETF in the world, do you actually own gold? The answer is NO. You are effectively buying shares in a fund indexed to the gold market. This is not the same thing as buying physical gold bullion and storing it in allocated vaults, a key distinction.

In fact, according to the ETF's own prospectus, the average investor can only redeem his or her gold shares for cash. Only those who have large holdings in a fund like GLD have the option to redeem their shares for physical gold, requiring somewhere in the neighborhood of 100,000 shares, which translates into millions of dollars. And even then it's a complicated process.Building on the prior "allocated vaults" reference by Ms. Lyster and the redemption comment above, we would add that GLD itself does, in fact, maintain physical gold in allocated accounts (meaning numbered bars are held (allocated) in trust for the fund and cannot be seized in the event of bankruptcy of the custodian or storage provider). Yet, according to its prospectus, GLD maintains an unallocated gold account for purposes of creation and redemption of fund units--that is, if a very large investor wishes to put physical gold into the fund or take it out, there is a three day limbo period (which can be extended by the fund manager) where the gold sits in an unallocated account, fully exposed to counterparty risk. More on this in a bit.

Ms. Lyster continues:

Also, in the case of GLD, the Trust does not insure its gold. Which means it may not have adequate sources of recovery if its gold is lost, damaged, stolen or destroyed. And this may surprise you when reading the prospectus as we have. According the prospectus for GLD:

"The amount of gold represented by the Shares will continue to be reduced during the life of the Trust due to the sales of gold necessary to pay the Trust's expenses irrespective of whether the trading price of the Shares rises or falls in response to changes in the price of gold."

And...

"Gold held in the Trust's unallocated gold account and any Authorized Participant's unallocated gold account will not be segregated from the Custodian's assets. If the Custodian becomes insolvent, its assets may not be adequate to satisfy a claim by the Trust or any Authorized Participant."

So if the custodian- in this case HSBC- runs into trouble, it may not be able to make good on your claim.Accordingly, we might imagine a crisis situation in which substantial redemptions (requests for physical gold by large holders) drain the gold from the GLD allocated account to the GLD unallocated account, wherein the redeemers are exposed to substantial counterparty risk in a narrow, yet strategic window in time. And, if anyone thinks we're prone to paranoia (which is possible), please search our blog for "MF Global JP Morgan." Because when the music stops and the bankruptcy papers are filed, only the last TBTF bank standing matters and is free to seize the booty (thank you Sen. Grassley).

So it would appear the only way to protect yourself as an investor when it comes to ETFs is to do detailed research on the fund, its assets, and carefully read its prospectus, and even then you are still dealing with counterparty risk. This is why some would argue that buying a gold liability, which is what a gold ETF is, defeats the purpose of owning gold in the first place, as precious metals are one of the few asset classes accessible to average investors that are not simultaneously another person's liability.

In any case, now you know about ETFs and if you're interested, you know to get your reading glasses ready to dissect the fine print.

[Ms. Lyster exits, stage left.]Read the prospectus, indeed.

But if one needs another example, consider the case of TLT, the BlackRock-managed 20+ Year [US] Treasury Bond ETF. Used by Treasury bulls and hedgers alike, it is one of the more popular and liquid ETFs since its inception in July 25, 2002 (registered ex nihlo vis a vis an SEC No Action Letter, thus, bypassing the usual SEC registration and review process). Nevertheless, it does have a current prospectus, which governs the principal investment strategies:

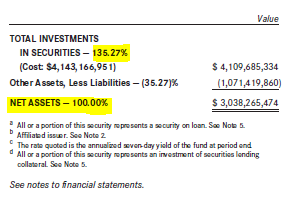

The Fund generally invests at least 90% of its assets in the bonds of the [Barclays US Treasury] Underlying Index and at least 95% of its assets in U.S. government bonds. The Fund may invest up to 10% of its assets in U.S. government bonds not included in the Underlying Index, but which [BlackRock Fund Advisors] BFA believes will help the Fund track the Underlying Index. The Fund also may invest up to 5% of its assets in repurchase agreements collateralized by U.S. government obligations and in cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates.So far, so good, despite the nebulous term "generally invests." The "up to 5%" investment in repos, cash and affiliated money market funds seems minimal and reasonable. But, then if we look at the Schedule of Investments in the last annual report, why is there a materially higher amount (36.01%) invested in affiliated, BlackRock money market funds?

The prospectus does state that, "The Fund may lend securities representing up to one-third of the value of the Fund's total assets (including the value of the collateral received)." Note that "total assets" is 35.27% higher than "net assets," a clever trick with definitions. But this does not explain everything.

From here, we need to read the Statement of Additional Information (yes, another, separate document), which is incorporated by reference into the prospectus, and which contains more detailed disclosures (emphasis ours):

With respect to loans that are collateralized by cash, the borrower will be entitled to receive a fee based on the amount of cash collateral. The Funds [sic TLT] are compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. In the case of collateral other than cash, a Fund is compensated by a fee paid by the borrower equal to a percentage of the market value of the loaned securities. Any cash collateral may be reinvested in certain short-term instruments either directly on behalf of each lending Fund or through one or more joint accounts or money market funds, including those affiliated with BFA; such reinvestments are subject to investment risk. BFA may receive compensation for managing these investments of collateral.Putting it all together, TLT may lend up to 33.33% of its total assets for cash, then invest that cash in BlackRock money market funds. Throw in the extra 5% for repos, cash and money market funds, and a total of 38.33% in money market funds is permitted (so the 36.01% investment is entirely legal).

Is this nefarious? Not quite, but it gets back to what happens in a crisis. While money market funds are ordinarily safe, one need only recall Lehman circa September, 2008 when the entire asset class locked up thanks to a freeze in the repo market after the greatest Fed-induced liquidity whipsaw in history. Presumably, the Fed and other "regulators" are prepared for that contingency.

Yet, the Fed itself has set up money market funds as a key prong in its future Whip Inflation Now tightening operations, when it must enact tightening policies to soak up the trillions in excess reserves it has created thanks to numerous "QE" programs. Recently revived contemplated regulatory changes may also allow money market funds to suspend redemptions.

So, in a pinch, what happens when markets lock up and Treasury fail-to-delivers (FTDs) prevent a return of the lent securities to TLT, and/or the cash invested in BlackRock money market funds is locked up thanks to a combination of redemption suspension and the Fed itself competing for its cash? While the official net asset value of TLT may not be affected thanks to accounting guidelines, just how wide (and lower) might TLT trade in the secondary market (on exchanges, where most investors buy and sell), as investor confidence shatters?

While we're not trying to fear monger, the point of this exercise is twofold: one, before investing in an ETF, read and understand (with the help of a professional, if necessary) all the fund documents and at least the most recent financials, including the notes. Two, perhaps consider all ETFs as an asset class when abiding by the 10% concentration rule.

Good luck investing, ladies and gents.

PHYS! (and American Eagles) And I still want to see Capital Account interview Sprott inside his vault.

ReplyDelete...and Ron Paul can count the bars :->

ReplyDeleteAnd drill a sample:)

ReplyDeleteI don't know why I remember it, she didn't tweet back, but LL reacted to a gold story a while back by tweeting that she wanted to do an interview inside a gold vault. I think it was after some haircut got access to the GLD vault for an interview of someone or other. I tweeted that Sprott has a vault, and Montreal is nice this time of year. Plus he's CA's type of guest. Just an idle book-talking thought....

Bob do you own any ETFs?

ReplyDeleteI ask because I would like to know what instrument to invest through. (Save for putting more bullion under the floor boards)Does one in your opinion invest through mutual funds, directly in stocks and bonds, ETFs, or some other vehicle? With all the vaporizations going on and presumably increasing during the next 'event' how do you hedge your exposure to the investment vehicle itself?

And thanks for the work it's appreciated

@Anon: No, I own no equities currently. When I have, they were companies for which I actually did business with or consulted for. I prefer to invest in tangible things.

ReplyDeleteI only trade futures. If I did trade equities, I would probably trade ETFS, and I would have a fixed account size, regularly withdrawing overages.

If I were to "invest" long term in equities, I would probably prefer mutual funds to ETFs, since they don't seem to play as many games with their assets. But there's no way to realistically eliminate or hedge counterparty risk for the next event. Maybe pray for a Fed backstop, which is entirely likely.