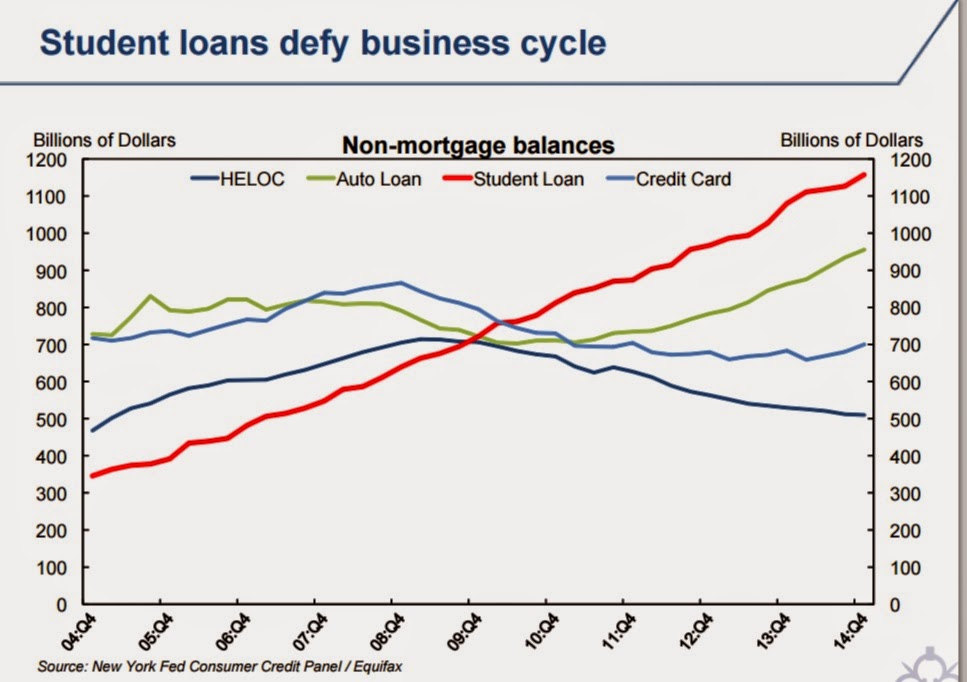

It is only because of government programs, that encourage students to take on this debt and government student loan guarantees that encourage bankers to make such loans, that student debt continues to soar.

Think about it. More student loans are made to students, who generally have extremely limited, or no income, than loans to wage earners in the credit card, auto or home equity sectors.

.Is it any wonder that only 29% of students are current with decreasing balances.

The finance bubble created around student loans has been an ongoing issue since decades ago. The problem will not be immediately resolved but at least the situation can be mitigated when the interest rates concern gets addressed.

ReplyDelete