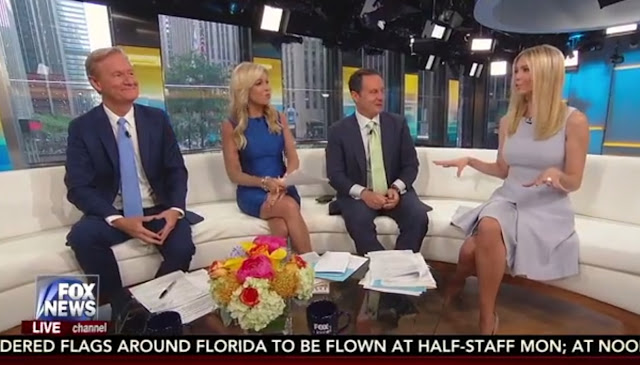

Ivanka Trump appeared on "Fox & Friends" this morning to promote the Trump Administration's plunge into workforce central planning.

During her appearance, she managed to bring out the ghost of John Maynard Keynes and didn't seem aware she was doing so.

In a brief mention of a boom in small business that she stated was occurring in the economy, she also mentioned that a friend had told her that is as though "the animal spirits have been released."

Of course, the term, animal spirits, was first introduced into economics by John Maynard Keynes in his book

into economics by John Maynard Keynes in his book The General Theory of Employment, Interest, and Money.

Murray Rothbard explained it was part of Keynes' view on the business cycle:

Keynes then came to the third economic class, to whom he was somewhat better disposed: the investors. In contrast to the passive and robotic consumers, investors are not determined by an external mathematical function. On the contrary, they are brimful of free will and active dynamism. They are also not an evil drag on the economic machinery, as are the savers. They are important contributors to everyone’s welfare.Or as Keynes put it:

But, alas, there is a hitch. Even though dynamic and full of free will, investors are erratic creatures of their own moods and whims. They are, in short, productive but irrational. They are driven by psychological moods and “animal spirits.” When investors are feeling their oats and their animal spirits are high, they invest heavily, but too much; overly optimistic, they spend too much and bring about inflation. But Keynes, especially in The General Theory, was not really interested in inflation; he was concerned about unemployment and recession, caused, in his starkly superficial view, by pessimistic moods, loss of animal spirits, and hence underinvestment.

The capitalist system is, accordingly, in a state of inherent macroinstability. Perhaps the market economy does well enough on the micro-, supply-and-demand level. But in the macro world, it is afloat with no rudder; there is no internal mechanism to keep its aggregate spending from being either too low or too high, hence causing recession and unemployment or inflation.

Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than mathematical expectations, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits—a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

So the far from intellectually deep (but a good poser) Ivanka has a friend who uses the term "animal spirits" to explain the current Federal Reserve money manipulated boom and she thinks the thought is original with her friend and doesn't appear aware that it is Keynes' term used to discuss the business cycle.

And I don't think she is aware that Keynes also thought that the animal spirit inspired boom could come crashing down at any time.

In estimating the prospects of investment, we must have regard, therefore, to the nerves and hysteria and even the digestions and reactions to the weather of those upon whose spontaneous activity it largely depends.She really has no clue what she is spouting out.

-RW

No comments:

Post a Comment