Justin Wolfer writes, "If you've heard the talking point that the economy is only creating low-wage jobs, please consult the facts, instead."

(Data via Wolfer)

Monday, February 29, 2016

The Case for Using Tarot Cards or a Ouija Board Over The New York Times

Don Boudreaux emails NYT:

Arguing for a 107 percent increase in the minimum wage (to $15 per hour), you dismiss fears that such a wage hike will destroy jobs by asserting that “[t]here is no proof for or against that position” (“Hillary Clinton Should Just Say Yes to a $15 Minimum Wage,” Feb. 18). While it’s true that the federal minimum wage has never been raised by such an amount, it is obtuse in the extreme to use this fact as a reason to plead ignorance of the likely consequences of a more than doubling of the minimum wage.

To probe the depth of your conviction that it is impossible, absent specific historical experience, to predict that an imposed 107 percent increase in price of some good or service will result in less of that good or service being purchased, here are some questions. Do you think that we have no way of knowing what will happen to the amount of housing that is purchased if the government orders all home sellers to raise the asking prices of their homes by 107 percent? (If your home in the Hamptons or your condo on Columbus Circle is currently on the market, do you honestly have no prediction about what will happen to your prospects of selling your property if Uncle Sam forces you to more than double your asking price?) What about a dictated 107 percent increase in college tuition? Or what if government commands all grocers to more than double the prices of the items sold in their stores? How about a mandated 107 percent hike in the price of newspaper subscriptions?

For each of these goods and services there is, by your reckoning, no “proof for or against” the position that such an enforced price rise will reduce the quantity of these goods and services that consumers demand. So if you really believe what you write about the minimum wage, you must also claim ignorance of the consequences of these other price hikes. Given your confessed ignorance, therefore, of economic reality, your readers would do better to seek policy advice from tarot cards or Ouija boards than from you.

Sincerely,

Donald J. Boudreaux

Professor of Economics

and

Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center

George Mason University

Fairfax, VA 22030

Donald J. Boudreaux

Professor of Economics

and

Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center

George Mason University

Fairfax, VA 22030

The above originally appeared at Cafe Hayek.

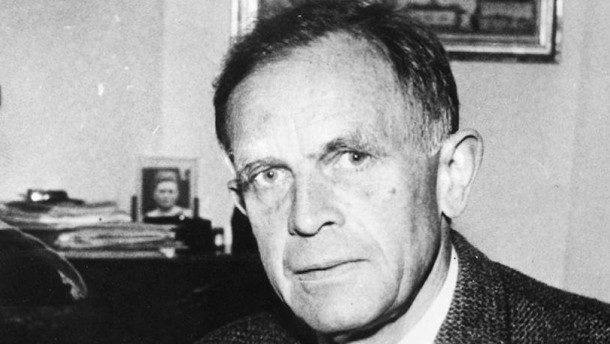

Wilhelm Röpke: The Economist Who Stood Up to Hitler

|

| Wilhelm Röpke |

Richard Ebeling emails:

Dear Bob,

I have a new article on the “EpicTimes” news and commentary website on, “Wilhelm Röpke: The Economist Who Stood Up to Hitler.”

Though not as widely known as he might be, Wilhelm Röpke is usually credited as one of the intellectual fathers of the "German Miracle" after the Second World War in terms of the free market-based policies leading to the country's economic recovery.

This February marks fifty years since his death In 1966, and it seems worthwhile to remember and pay tribute to him.

Röpke was also one of the few prominent Germans who continued to publicly speak out in no uncertain terms against Hitler after be came to power, warning that Germany under the Nazis was sinking into barbarism, irrationality, brutality, and a dangerous racist form of collectivism. He finally was forced to leave Germany when Nazi thugs threatened him and his family.

Teaching in neutral Switzerland during and after the Second World War, Röpke proceeded to publish a series of books explaining how Western Civilization had reached this crisis of a collectivist and totalitarian revolt against individual liberty, free markets, and limited government under the rule of law.

He also outlined the principles, policies and cultural ideals that were necessary if after the catastrophe of war, the world and a post-Nazi Germany were to restore a decent, humane, peaceful, productive, and free society.

His books and ideas became an inspiration and guide for many of the policies introduced in Germany starting in the late 1940s that put that country on an economic path of an “economic miracle” of renewed prosperity that exceeded the postwar recoveries of some of the victorious nations.

While not a proponent of laissez-faire in a variety of economic and social policy areas, Röpke strongly warned of the dangers and pitfalls arising from the growing interventionist-welfare state.

His economic diagnosis and policy proposals, combined with a strong emphasis on the importance of an ethical anchor for the preservation of human liberty and an open, decent society makes his ideas as timely today as when he penned them decades ago.

http://www.epictimes.com/richardebeling/2016/02/wilhelm-ropke-the-economist-who-stood-up-to-hitler/

Best,

Richard

Koch Brother Cuts Price of Aspen Estate to $80 Million

In 2015, he sold several high-profile pieces of art, including, for $67.5 million, Pablo Picasso’s “The Nightclub Singer", reports WSJ.

Now he wants to sell an Aspen, Colorado property so bad that he has cut the price from $100 million to $80 million.

Known as Elk Mountain Lodge, the eight-bedroom main house on the property measures roughly 15,000 square feet. With views of the surrounding mountains, it has two hot tubs, a dining room that seats about 20 people, temperature-controlled wine storage and a media room that doubles as an altitude acclimation room.

It is not clear why he did not construct a separate altitude acclimation room.

-RW

The Myth That Gold Is a Great Performer During A Recession

On Friday, I reported on an advisory on gold, Deutsche Bank: It’s Time to Buy Gold.

In my post, I noted:

Gold hardly ever goes up during a recession/depression. A recession/depression is a period of general asset liquidation, including gold.

This can be understood by taking a look at the last 5 recession. (Gray shaded areas are periods of recession.)

During the 1980 recession, the price of gold collapsed.

Things were even worse in the recession that started in 1981. Gold never recovered to its pre-1980 recession levels and crashed to as low as $314.00 an ounce.

Here is what occurred during the 1990 recession.

During the 2001 recession, gold was actually up, but that was probably because gold had been declining for nearly a decade before that. From that perspective, the gold climb was not that impressive.

Here is gold's performance during the most recent recession.

To be sure, gold tends to be a leader coming out of a recession, but that is at the end of a recession. But even then, the price remains lower than it was at the peak reached during the early months of a recession.

Thus, if one is expecting a recession, the last thing you generally want to do is buy gold, especially if you think it is going to be a severe recession. There are exceptions to this rule if there is stagflation, that is, a recession and accelerating price inflation, but the driver of the gold price during such a period is the inflation and not the recession.

As I said in my original post, gold should be bought at the present time aggressively but as protection against accelerating price inflation, not as a hedge against a downturn in the economy.

If you, however, think we are in the initial stages of a recession (and that the Fed is "stuck" and "can't get inflation going and interest rates will be pushed back down"). it will mean a general liquidation of assets, and gold should be sold. I consider the view that we are on the edge of a recession at present absurd. No doubt, the Fed manipulated boom will end at some point but there is no indication it is going to end soon. The indicators (which I report on in the EPJ Daily Alert) point to an acceleration in price inflation and that is the major reason to buy gold now.

-RW

In my post, I noted:

It is a myth that gold goes up during a recession/depression. There were very specific circumstances why gold went up during the Great Depression, that, is FDR manipulated the price higher via Treasury buying, for the benefit of John Maynard Keynes and Bernard Baruch.I got the usual response by those who believe gold always goes up. These were the comments left under the post:

Gold does go up during deflationary depressions. People get scared. It also goes up during inflationary depressions.

Gold hardly ever goes up during a recession/depression. A recession/depression is a period of general asset liquidation, including gold.

This can be understood by taking a look at the last 5 recession. (Gray shaded areas are periods of recession.)

During the 1980 recession, the price of gold collapsed.

Things were even worse in the recession that started in 1981. Gold never recovered to its pre-1980 recession levels and crashed to as low as $314.00 an ounce.

Here is what occurred during the 1990 recession.

During the 2001 recession, gold was actually up, but that was probably because gold had been declining for nearly a decade before that. From that perspective, the gold climb was not that impressive.

To be sure, gold tends to be a leader coming out of a recession, but that is at the end of a recession. But even then, the price remains lower than it was at the peak reached during the early months of a recession.

Thus, if one is expecting a recession, the last thing you generally want to do is buy gold, especially if you think it is going to be a severe recession. There are exceptions to this rule if there is stagflation, that is, a recession and accelerating price inflation, but the driver of the gold price during such a period is the inflation and not the recession.

As I said in my original post, gold should be bought at the present time aggressively but as protection against accelerating price inflation, not as a hedge against a downturn in the economy.

If you, however, think we are in the initial stages of a recession (and that the Fed is "stuck" and "can't get inflation going and interest rates will be pushed back down"). it will mean a general liquidation of assets, and gold should be sold. I consider the view that we are on the edge of a recession at present absurd. No doubt, the Fed manipulated boom will end at some point but there is no indication it is going to end soon. The indicators (which I report on in the EPJ Daily Alert) point to an acceleration in price inflation and that is the major reason to buy gold now.

-RW

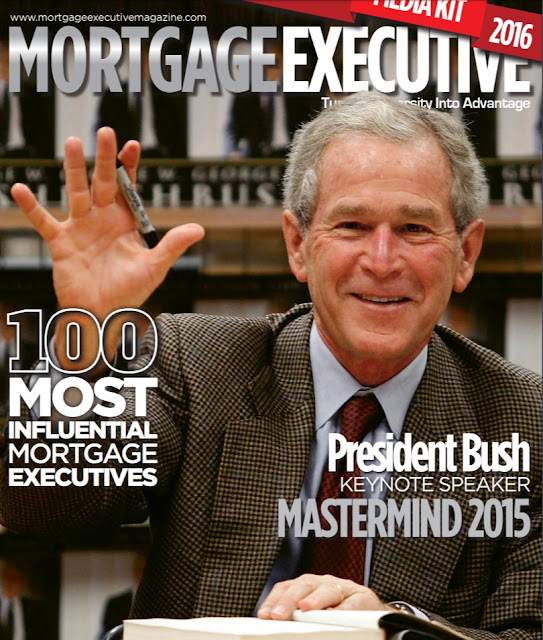

OMG In 2015 George W. Bush Gave a Keynote Speech at an Off-the-Wall Real Estate Get Rich Conference

Here's Tony Robbins speaking at the 2012 Mastermind Summit. Oh yeah, this is how you are going to get rich in real estate.

.

Sunday, February 28, 2016

Is a Major Wall Street Bank Beefing Up For More Government Debt Crises?

Peter Orszag has left Citigroup to join Lazard,

This is an interesting move and I note it here because he was a former budget director in Obama’s White House and has been a Robert Rubin operative. He is a total establishment technocrat.

No doubt, it was Rubin who got him the job at Citi, where he was chairman of the financial strategy and vice-chair of investment banking. So why the move?

As FT notes, Lazard has become the go-to bank for countries on the brink of financial collapse.

Matthieu Pigasse, who heads Lazard’s sovereign advisory unit, worked closely with the Greek government to advise it on its debt burden reduction and advised Ukraine’s leadership after Russia annexed Crimea.

Could Lazard be beefing up for more crises with the addition of Orszag?

“Peter is one of the most respected economic advisers on the world stage,” said Ken Jacobs, Lazard chief executive. “His expertise in finance, capital markets and public policy across industry sectors will be invaluable.”

“Lazard occupies a unique position in global investment banking as a trusted advisor to leaders of business and government worldwide,” said Orszag. “I’m looking forward to working with the highest concentration of senior-level advisory bankers in the industry.”

Orszag obtained a Ph.D. in economics from the London School of Economics.

-RW

U.S. Home Prices Have Exceeded Their 2005 Peak

This is not what a recession looks like. It is not what a "stuck" Fed looks like.

Keynesians and Austrian-lites don't understand the business cycle.

-RW

(Chart via Tyler Cowen)

The Problems with Bernie Sanders Economics

I have posted a great discussion by Jeff Deist at Target Liberty.

The discussion on Sanders economics starts at 11:00.

The discussion on Sanders economics starts at 11:00.

Indications of Surprise by Keynesian Economists in the Strength of the Economy

Citi's Economic Surprise Index has been surging lately.

The Index is a data series that measures how data releases have generally compared to economists’ prior expectations. When data is coming in weaker than expected, it declines; when data is coming in stronger than expected, it rises.

Keynesians just don't understand the business cycle.

-RW

UPDATE

And then we have this:

The Index is a data series that measures how data releases have generally compared to economists’ prior expectations. When data is coming in weaker than expected, it declines; when data is coming in stronger than expected, it rises.

Keynesians just don't understand the business cycle.

-RW

UPDATE

And then we have this:

Recession-callers not looking so good. https://t.co/0dIAXJ87hv pic.twitter.com/Bc4P60TAaK

— Joseph Weisenthal (@TheStalwart) February 28, 2016

Chinese Gold Reserves Grow by 16 Tons In January

Chinese and Russian gold accumulation continue. Not good for the world's reserve currency, the US dollar.

No Kidding

Is Donald Trump Keynes-Like in Some Ways?

The unpredictablity that Hayek mentioned that Keynes had reminds me of Trump. Also the ability to sway the masses and reliance on gut instincts rather than well reasoned thinking.

-RW

-RW

Saturday, February 27, 2016

The Confused Masses of Oakland

Supporters for socialist Bernie Sanders march in Oakland.

(via QuinnDaGhost)

We see you Oakland!— BernieCantBeBought (@QuinnDaGhost) February 27, 2016

This is the revolution and it will not be televised...#MarchForBernie #FeelTheBernpic.twitter.com/MmcxQmRUeN

(via QuinnDaGhost)

Puusy Riot Loves What Socialist Bernie Sanders Stands For

just visited Bernie campaign office in Washington— Pussy Riot (@pussyrrriot) February 26, 2016

thank u guys for an inspiration!

I love what u stands for! pic.twitter.com/h286rAn3e4

They are obviously much too young to remember what Russia was like under communism.

And who is paying for their continuing travel throughout the US?

hi team— Pussy Riot (@pussyrrriot) February 26, 2016

my ass just landed in Washington, and I urgently need a t-shirt with Bernie. could i pick it up somewhere tomorrow morning? Nadya

Is this the first indication that the CIA is anti-Trump?

.@pussyrrriot to American voters: If you want your *own* Putin, vote for Trump https://t.co/LlaG7uT6rz pic.twitter.com/yypv4NXUFW— The WorldPost (@TheWorldPost) December 18, 2015

Did Trump Forge a Signature On a Trump University Contract?

I question a lot of the statements Donald Trump has made in his presidential bid, but wording attempting to discredit him in a document discussing Trump University appears exceptionally awkward at best, or, more likely, more misleading than anything ever put into a Trump University contract.

David Freddoso tweets out the below. It appears to come from a court document, but possibly from a story about Trump University. Freddoso does not identify the source.

What catches ones eye in the above is the use of "Trump University" and "Trump University representatives" which is suddenly dropped at key points for the use of "Trump.". There is this for example,

People in Trump's league are very careful. They are always targets for lawsuits. They don't do idiot stuff like forging a signature on a $35,000 contract. This is not to say it couldn't have been done way down the totem pole at Trump University by some guy trying to make a quota, but Trump would never have had any role in it. In fact, I'm guessing that Trump University was probably a branding deal where Trump threw his name on the program and having nothing to do with day-to-day details.

The author of the above may claim that he was just using the word "Trump," as an abbreviation for "Trump Universiy representative" but this is certainly much slicker than anything I saw from Trump Univeristy reps when I popped in on their pitch way back when.

It's pretty clear who has the con going on in this litigation and it is not Donald J. Trump.

-RW

David Freddoso tweets out the below. It appears to come from a court document, but possibly from a story about Trump University. Freddoso does not identify the source.

What catches ones eye in the above is the use of "Trump University" and "Trump University representatives" which is suddenly dropped at key points for the use of "Trump.". There is this for example,

Winklemann realized that Trump had forged her signature on the contracts when Trump responed by submitting to the credit card companies copies of the forged document.It sure gives the impression that Trump was up in his office high above Manhattan at Trump Tower forging documents. This is absurd. I have no idea if Trump is worth $300 million or $10 billion but he is a very serious player. I know lawyers he has employed and people he has done deals with. There is nothing small-time about Trump.The idea that he would get involved in the details of a $35,000 contract is ridiculous, much less force through such a contract with a forged signature.

People in Trump's league are very careful. They are always targets for lawsuits. They don't do idiot stuff like forging a signature on a $35,000 contract. This is not to say it couldn't have been done way down the totem pole at Trump University by some guy trying to make a quota, but Trump would never have had any role in it. In fact, I'm guessing that Trump University was probably a branding deal where Trump threw his name on the program and having nothing to do with day-to-day details.

The author of the above may claim that he was just using the word "Trump," as an abbreviation for "Trump Universiy representative" but this is certainly much slicker than anything I saw from Trump Univeristy reps when I popped in on their pitch way back when.

It's pretty clear who has the con going on in this litigation and it is not Donald J. Trump.

-RW

Warren Buffett: "My normal neighbors live better than John D. Rockefeller did a century ago"

Paging Don Bordeaux.

Buffett writes in his shareholder letter that is just out: "My normal neighbors live better than John D. Rockefeller did a century ago."

I wonder where Buffett got that point. SEE How Much Money Would It Take For You to Change Places with John D. Rockefeller at His Prime?

Robert Reich Endorses Socialist Bernie Sanders

Reich has released this statement:

He is best known by anti-Keynesians for buying a house in Berkeley at the peak of the housing bubble.

I endorse Bernie Sanders for President of the United States. He’s leading a movement to reclaim America for the many, not the few. And such a political mobilization – a “political revolution,” as he puts it -- is the only means by which we can get the nation back from the moneyed interests that now control so much of our economy and democracy.

This extraordinary concentration of income, wealth, and political power at the very top imperils all else – our economy, our democracy, the revival of the American middle class, the prospects for the poor and for people of color, the necessity of slowing and reversing climate change, and a sensible foreign policy not influenced by the “military-industrial complex,” as President Dwight Eisenhower once called it. It is the fundamental prerequisite: We have little hope of achieving positive change on any front unless the American people are once again in control.

I have the deepest respect and admiration for Hillary Clinton, and if she wins the Democratic primary I’ll work my heart out to help her become president. But I believe Bernie Sanders is the agent of change this nation so desperately needs.Reich, who worked in the Gerald Ford and Jimmy Carter administrations and was Secretary of Labor under Bill Clinton, is currently Chancellor’s Professor of Public Policy at the University of California at Berkeley.

He is best known by anti-Keynesians for buying a house in Berkeley at the peak of the housing bubble.

Friday, February 26, 2016

HATE IS NOT ENOUGH: The Serious Problem with Bernie's Anti-Fed Position

By C. Jay Engel

Bernie Sanders’s advice on fixing the Fed demonstrates the fact that being “anti-Fed” is not enough. One must not just be a critic of the Fed. One must also know what the Fed is doing that is bad, and what the better solution would be. Unfortunately, those of us who think that the Fed has been an engine of trouble in the US economy over the last many decades are sometimes lumped together with socialist critics of Fed policy. But the free market approach to money and banking has nothing in common with Bernie Sanders.

Sanders took to The New York Times last month to lament that the “recent decision by the Fed to raise interest rates is the latest example of the rigged economic system.” Now, perhaps it is true that the decision by the Fed is an example of rigging the system. But it is only true in a way that Sanders never intends. For Sanders, it is thesuppression of interest rates that should be the goal, not their being raised. But in fact, both raising and suppressing the rates of interest is, by definition, rigging the economy.

Interest rates function in an unhampered market as a result of the interaction between creditors and debtors, capitalists and borrowers. It is the effort to change the interest rate either up or down away from the market rate of interest that constitutes a system being “rigged.”

Moreover, Sanders complains that interest rates should only be raised if and when policy officials begin to see rising prices. Since “price inflation” has been low over the last several years, the assertion is made that there should be no hurry to leave the position of near-zero interest rates. The problem of this argument — especially from the Austrian view — is that price inflation per se is not the problem, it is only one possible symptom of the problem. It is akin to arguing that the cause of internal bleeding is of no concern because there is no external wound that yet warrants a band-aid.

The problem with low interest rates, if they are low due to suppression by the central bank, is that they come about artificially; that is, they come about not because people have saved more and want to allocate their savings to investments, but rather because the banks have expanded the supply of money and credit in the economy.

But money is not wealth. Money is a claim on wealth (i.e., real resources). Thus, an expansion of the money supply gives the illusion of an increase in wealth; but in reality there are now simply many more claims to a fixed amount of wealth. This can lead to price inflation, but more importantly, it leads to the misallocation of resources to the first holders of the new money.

Sanders’s entire plan rests on the idea that what the economy needs is an influx of new lending: he wants the Fed to encourage — instead of discourage — commercial banks to increase their extension of loans. But this is completely the wrong model. What is needed is not more cheap debt. Rather, what is needed is improvement in capital formulation. What is needed is deleveraging and liquidation. What is needed is the thing that Keynesian economists fear most: savings, deferment of mass consumption, and a sound currency.

The above originally appeared at Mises.org.

This Is Pretty Amazing

The robots Are coming

A new version of Atlas, designed to operate outdoors and inside buildings has been created. It is specialized for mobile manipulation and is electrically powered and hydraulically actuated. It uses sensors in its body and legs to balance and LIDAR and stereo sensors in its head to avoid obstacles, assess the terrain, help with navigation and manipulate objects.

-RW

A new version of Atlas, designed to operate outdoors and inside buildings has been created. It is specialized for mobile manipulation and is electrically powered and hydraulically actuated. It uses sensors in its body and legs to balance and LIDAR and stereo sensors in its head to avoid obstacles, assess the terrain, help with navigation and manipulate objects.

-RW

GDP Gets Surprise Upward Revision

GDP was unexpectedly revised to a 1 per cent annualised climb in the fourth quarter from 0.7 per cent, the Commerce Department said this morning.

A downward revision to 0.4 per cent had been forecast by Keynesian econometricians.

GDP is my least favorite indicator, but still you don't see this kind of activity in this number during the down phase of the business cycle.

-RW

Deutsche Bank: It’s Time to Buy Gold

Deutsche Bank analysts have put out a note advising that now is the time to buy gold. They write in part:

The bank also suggests that economic weakness may develop and be a positive for gold, but in the EPJ Daily Alert, I have argued that the developing threat over the next 6 months is not the down phase of the business cycle but rather an acceleration in price inflation.

It is a myth that gold goes up during a recession/depression. There were very specific circumstances why gold went up during the Great Depression, that, is FDR manipulated the price higher via Treasury buying (For the benefit of John Maynard Keynes and Bernard Baruch).

Gold should be bought here aggressively but in as protection against accelerating price inflation, not a downturn in the economy.

-RW

Buying some gold as 'insurance"is warranted...We would...argue that given the plethora of negative deposit rates globally, the holding cost of gold is now negligible in many jurisdictions, and therefore gold deserves to be trading at elevated levels versus many other assets.

The bank also suggests that economic weakness may develop and be a positive for gold, but in the EPJ Daily Alert, I have argued that the developing threat over the next 6 months is not the down phase of the business cycle but rather an acceleration in price inflation.

It is a myth that gold goes up during a recession/depression. There were very specific circumstances why gold went up during the Great Depression, that, is FDR manipulated the price higher via Treasury buying (For the benefit of John Maynard Keynes and Bernard Baruch).

Gold should be bought here aggressively but in as protection against accelerating price inflation, not a downturn in the economy.

-RW

The Flaws and Fallacies of Keynesian Economics

Richard Ebeling emails:

Dear Bob,

I participated in the February 24, 2016 “Libertarian Angle,” webinar sponsored by the Future of Freedom Foundation, with the Foundation’s president, Jacob G. Hornberger, on the topic:“The History of Economic Thought, Part 6: The Flaws and Fallacies of Keynesian Economics.”

In this new part, the theme is a critical analysis of John Maynard Keynes’ economics and the Great Depression. Keynes had been one of the most well-known British economists even before the appearance of his 1936 book, “The General Theory of Employment, Interest and Money.” He had opposed the gold standard, called for domestic monetary and fiscal manipulation to “stimulate” domestic demand and employment, and called for government to increase its intervention in the marketplace.

“The General Theory” was clearly an attempt to provide a theoretical foundation to his ad hoc economic policy proposals and stances. But when looked at in detail, every one of the building-blocks for his new macroeconomics – people’s asserted “psychological law" of a "propensity to consume” out of income; a supposed “money illusion” on the part of workers concerning their wages: a view of businessmen as dominated by irrational “animal spirits” in their investment decision-making; and a belief that government’s could micro-manage the “macro”-economy through monetary and fiscal policy – were and are all fundamentally flawed.

Dominating the economics profession for more than two decades following the Second World War, Keynesian Economics continues to misdirect economic understanding and thinking about how the market economy actually works, and what are the sounder policies for long-run economic stability, growth, and coordination of supply and demand.

Best,

Richard

Dear Bob,

I participated in the February 24, 2016 “Libertarian Angle,” webinar sponsored by the Future of Freedom Foundation, with the Foundation’s president, Jacob G. Hornberger, on the topic:“The History of Economic Thought, Part 6: The Flaws and Fallacies of Keynesian Economics.”

In this new part, the theme is a critical analysis of John Maynard Keynes’ economics and the Great Depression. Keynes had been one of the most well-known British economists even before the appearance of his 1936 book, “The General Theory of Employment, Interest and Money.” He had opposed the gold standard, called for domestic monetary and fiscal manipulation to “stimulate” domestic demand and employment, and called for government to increase its intervention in the marketplace.

“The General Theory” was clearly an attempt to provide a theoretical foundation to his ad hoc economic policy proposals and stances. But when looked at in detail, every one of the building-blocks for his new macroeconomics – people’s asserted “psychological law" of a "propensity to consume” out of income; a supposed “money illusion” on the part of workers concerning their wages: a view of businessmen as dominated by irrational “animal spirits” in their investment decision-making; and a belief that government’s could micro-manage the “macro”-economy through monetary and fiscal policy – were and are all fundamentally flawed.

Dominating the economics profession for more than two decades following the Second World War, Keynesian Economics continues to misdirect economic understanding and thinking about how the market economy actually works, and what are the sounder policies for long-run economic stability, growth, and coordination of supply and demand.

Best,

Richard

The Ten Most Distressed Cities in the United States

While most of the US is in a Fed-manipulated boom, there are pockets of distress. Below, based on analysis from the Economic Innovation Group using Census Bureau data is a map identifying the ten most distressed cities in the United States.

-RW

-RW

A Developing Puerto Rican Condom Problem

Don Boudreaux writes a letter to CNN Money:

The above originally appeared at Cafe Hayek.In your report on the Puerto Rican government freezing the price of condoms, you write “Condom prices in Puerto Rico are cheap and aren’t going up anytime soon” (“Puerto Rico freezes condom prices,” Feb. 24).Wrong. The price freeze will prevent the Zika-inspired rise in the demand for condoms from calling forth an increase in the quantity of condoms supplied to satisfy that higher demand. The resulting shortage of condoms will prompt some people to wait in queues to buy condoms, cause other people to turn to black-market suppliers, and cause yet other people simply to not use condoms during sex. Each of these consequences reflects the reality that the price freeze, rather than keeping the cost of condoms “cheap,” will raise that cost inordinately – and, in the process, further promote the spread of Zika.People are in dire need of a prophylactic against such forceful and harmful government intrusions.Sincerely,

Donald J. Boudreaux

Professor of Economics

and

Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center

George Mason University

About the Fraud Charges Against Donald Trump and His Trump University

Donald Trump is facing three separate lawsuits -- two class action suits filed in California and one filed by New York's attorney general. They concern a real estate education program that operated, between 2005 and 2010, under the name, Trump University, that took in an estimated $40 million.

Marco Rubio brought the suits up in last night's debate.

Here is what you need to know:

Marco Rubio brought the suits up in last night's debate.

Here is what you need to know:

First, these are civil fraud charges, not criminal charges, In this day and age anyone can bring a civil fraud charge for just about any reason.

In 2013, long before Donald Trump announced his candidacy for the Republican nomination, New York's attorney general, Eric Schneiderman, brought the first suit. I discussed the merits of the suit at that time in a post, In Defense of Donald Trump.

-RW

Thursday, February 25, 2016

BAM: IT CONTINUES Romer and Romer Have Issued a Detailed Critique of the High Growth Economic Projections for a Bernie Sanders Economy

According to an analysis by University of Massachusetts professor Gerald Friedman, Bernie Sanders’ proposed economic policies would result in average annual output growth of the US economy of 5.3% over the next decade,

Economists Krueger, Goolsbee, (Christina) Romer and Tyson, initially disputed the projections in an open letter to Sanders and Friedman.

Paul Krugman has used the letter as a starting point to savage the Friedman analysis in a series of NYT blog posts.

Friedman responded with his own letter in part charging that

[T]he CEA-chairs’ letter: substitut[ed] attack language and ad hominem argument for reasoned discourse. If you had taken the time to read my paper, you would find, as others have, that I evaluate the Sanders program using standard assumptions and methods. Rather than jumping on my conclusion, a more constructive discussion would focus on identifying possible errors in my method that may have led to conclusions that may seem implausible. Certainly, we can agree that it is illogical to reject conclusions without finding fault with method.Now, one of the authors of the original letter, Christina Romer and her husband David Romer and responded with a detailed critique.

Their conclusion:

The bottom line of our evaluation of Professor Friedman’s analysis is that it is highlyBoth sides here are, of course, using extremely problematic Keynesian models, but it still is fun to see them rip apart each others shaky models.

deficient. The estimated demand-induced effects of Senator Sanders’s policies are not just

implausibly large but literally incredible. Moreover, even if they were not deeply flawed,

Freidman’s enormous estimates of demand-fueled growth could not and would not come to pass. Even very generous estimates of the amount of slack still present in the American economy would not be enough to accommodate demand-driven growth of anything near what Friedman is estimating. As a result, inflation would soar and monetary policy would swing strongly to counteract them. Finally, a realistic evaluation of the impact of Senator Sanders’s policies on productive capacity (something that is neglected in Friedman’s analysis) suggests that those impacts are likely small and possibly negative.

-RW

US Treasury Postpones $28 Billion Bond Auction

For the record.

The US Treasury has cancelled an auction of seven-year debt and pushed it back to Friday.

The cancellation of the $28bn sale was due to a “technical issue,” according to a spokesperson for the US Treasury who declined to elaborate further.

-RW

The US Treasury has cancelled an auction of seven-year debt and pushed it back to Friday.

The cancellation of the $28bn sale was due to a “technical issue,” according to a spokesperson for the US Treasury who declined to elaborate further.

-RW

Halliburton to Cut 5,000 More Jobs

Crunch!

The oil sector continues to be squeezed.

Halliburton Co. has just announced it is slashing 5,000 positions, or 8% of its global workforce. The latest round of cost-cutting comes less than a month after Halliburton said it had laid off another 4,000 workers at the end of 2015.

Yesterday, North Dakota's largest oil producer, Whiting Petroleum, said it would suspend all fracking.

It is the biggest cutback to date by a major U.S. shale company reacting to the plunge in crude prices.

Enjoy the low gasoline prices while you can. They will not last. Global oil production is only months away from serious decline.

Please note: This is not a business cycle related collapse. It is a sector problem. The overall Fed-manipulated boom remains in progress.

-RW

The oil sector continues to be squeezed.

Halliburton Co. has just announced it is slashing 5,000 positions, or 8% of its global workforce. The latest round of cost-cutting comes less than a month after Halliburton said it had laid off another 4,000 workers at the end of 2015.

Yesterday, North Dakota's largest oil producer, Whiting Petroleum, said it would suspend all fracking.

It is the biggest cutback to date by a major U.S. shale company reacting to the plunge in crude prices.

Enjoy the low gasoline prices while you can. They will not last. Global oil production is only months away from serious decline.

Please note: This is not a business cycle related collapse. It is a sector problem. The overall Fed-manipulated boom remains in progress.

-RW

If You Were to Buy One of Everything Listed On Amazon, How Much Would It Cost?

About $12.86 billion, Kynan Eng, a computer scientist based in Zurich, calculates.

Eng, who by day is the president of iniLabs, a Zurich-based company that focuses on brain research and computers, with a side interest in using virtual reality as a rehabilitation tool, found the amount as a result of answering questions on Quora.

He came to Quora to respond to questions about the intersection between neuroscience and human-computer interaction but then "fairly quickly found myself getting diverted answering silly questions," he said from Switzerland, according to CNBC.

One of his first answers was about how much money was spent rescuing Matt Damon in all his various movies.

The total came out to $900 billion "plus change," he wrote.

That included $100,000 for the search party in Saving Private Ryan, $100 million for space station security deployment and damages in Elysium and $200 billion for the Mars mission and rescue in The Martian.

He's also come up with a name for his new hobby.

"I call it 'amateur fictional economics,'" he said.

Eng, who by day is the president of iniLabs, a Zurich-based company that focuses on brain research and computers, with a side interest in using virtual reality as a rehabilitation tool, found the amount as a result of answering questions on Quora.

He came to Quora to respond to questions about the intersection between neuroscience and human-computer interaction but then "fairly quickly found myself getting diverted answering silly questions," he said from Switzerland, according to CNBC.

One of his first answers was about how much money was spent rescuing Matt Damon in all his various movies.

The total came out to $900 billion "plus change," he wrote.

That included $100,000 for the search party in Saving Private Ryan, $100 million for space station security deployment and damages in Elysium and $200 billion for the Mars mission and rescue in The Martian.

He's also come up with a name for his new hobby.

"I call it 'amateur fictional economics,'" he said.

Trump Responds to Romney

It doesn't sound like Donald Trump will be releasing his tax returns anytime soon.

He has responded to Mitt Romney's charge that there may be a "bombshell" in his tax returns.

He has responded to Mitt Romney's charge that there may be a "bombshell" in his tax returns.

Mitt Romney,who totally blew an election that should have been won and whose tax returns made him look like a fool, is now playing tough guy— Donald J. Trump (@realDonaldTrump) February 24, 2016

When Mitt Romney asked me for my endorsement last time around, he was so awkward and goofy that we all should have known he could not win!— Donald J. Trump (@realDonaldTrump) February 24, 2016

Mitt Romney, who was one of the dumbest and worst candidates in the history of Republican politics, is now pushing me on tax returns. Dope!— Donald J. Trump (@realDonaldTrump) February 25, 2016

Just for your info, tax returns have 0 to do w/ someone’s net worth. I have already filed my financial statements w/ FEC. They are great!— Donald J. Trump (@realDonaldTrump) February 25, 2016

Signing a recent tax return- isn't this ridiculous? pic.twitter.com/UdwqF4iZIZ— Donald J. Trump (@realDonaldTrump) February 25, 2016

US Declares Financial War On Russia

I am stunned by the report on the front page of today's Wall Street Journal:

I'm sure Lou Jiwei is taking notes.

-RW

The U.S. government has warned some top U.S. banks not to bid on a potentially lucrative but politically risky Russian bond deal, saying it would undermine international sanctions on Moscow, people familiar with the matter said.The U.S. better be careful. Fueling the idea of financail war may not be such a good idea, especially with China holding $1.3 trillion in US Treasury security debt.

The move, apparently the first of its kind since the sanctions went into effect, has sent Wall Street bankers scrambling to determine whether the opportunity for new business is worth the political downside of bucking the administration’s warning. The rules don’t explicitly prohibit banks from pursuing the business, but U.S. State Department officials hold the view that helping finance Russia would run counter to American foreign policy.

Russia plans to issue at least $3 billion of foreign bonds—its first international issue since the U.S. and its allies imposed sanctions in 2014 following Moscow’s annexation of Crimea and support for separatists in Ukraine, according to people familiar with the matter.

Russia invited European and Chinese banks to bid on the deal as well as several from Wall Street, including Bank of America Corp, Citigroup Inc., Goldman Sachs Group Inc., J.P. Morgan Chase & Co. and Morgan Stanley, the people said.

So far, there is no consensus among the Wall Street firms about whether to move ahead. Some bank officials, including at Citigroup, say they won’t participate. Other banks, including Goldman and J.P. Morgan, continue to weigh their options....

U.S. government officials say helping Russia finance its debt would run counter to the objectives of the sanctions.

“It is essential that private companies—in the U.S., EU and around the world—understand that Russia will remain a high-risk market so long as its actions to destabilize Ukraine continue,” the State Department said in a statement to The Wall Street Journal.

I'm sure Lou Jiwei is taking notes.

-RW

Bloomberg Vicious Hit on Trump

Stephanie Baker and Tim Higgins write in Bloomberg in what is being called a "Special Report":

They are in a kind of reverse osmosis Trump world. The methods Trump uses to attack those who challenge his presidential run,, exaggeration and stretching of the truth, are the methods they are using to attack Trump.

-RW

In Panama, his condominium owners are trying to fire him. In Canada and Turkey, his business partners want to cut him loose. In Scotland and Ireland he claims to be making millions but so far is losing money.

Donald Trump says his organization is in talks on more than 100 deals, 85 percent of them outside the U.S., and that if elected president he will bring to international relations the savvy he has demonstrated as a global deal maker.

But an examination of his operations abroad reveals that, while he has made many millions selling his name, he has chosen a number of inexperienced -- even questionable -- partners, sometimes infuriated buyers and associates and moved late into saturated markets, producing less income than advertised.But if you read the details, there is no question that Baker and Higgins are attempting to put the worst possible spin on everything Trump touches.

They are in a kind of reverse osmosis Trump world. The methods Trump uses to attack those who challenge his presidential run,, exaggeration and stretching of the truth, are the methods they are using to attack Trump.

-RW

China Warns U.S. After Trump Wins Nevada Caucus

China warned the United States on Wednesday not to adopt punitive currency policies that could disrupt U.S.-China relations after Donald Trump’s win in the Nevada caucus.

Foreign Ministry spokeswoman Hua Chunying told reporters in Beijing that “we are following with interest the U.S. presidential election.”

Hua was asked about China’s response to a possible Trump presidency and his announced plan to punish China for currency manipulation with a tax on Chinese goods.

“Since it belongs to the domestic affair of the U.S., I am not going to make comments on specific remarks by the relevant candidate,” she said.

“But I want to stress that China and the U.S., as world’s largest developing and developed countries, shoulder major responsibilities in safeguarding world peace, stability and security and driving world development,” the spokeswoman added.

“The sustained, sound and steady growth of China-U.S. relations serves the fundamental and long-term interests of the two countries and benefits the world. We hope and believe that the U.S. government will pursue a positive policy toward China in a responsible manner.”

The comments came as Wang Yi, the Chinese foreign minister, is holding talks in Washington that include U.S. concerns about a Chinese military buildup on disputed islands in the South China Sea, and cooperation on dealing with North Korea’s nuclear and missile provocations.

Hua said Wang and Secretary of State John Kerry agreed the two sides will enhance cooperation and increase talks and exchanges.

(via The Free Beacon)

Foreign Ministry spokeswoman Hua Chunying told reporters in Beijing that “we are following with interest the U.S. presidential election.”

Hua was asked about China’s response to a possible Trump presidency and his announced plan to punish China for currency manipulation with a tax on Chinese goods.

“Since it belongs to the domestic affair of the U.S., I am not going to make comments on specific remarks by the relevant candidate,” she said.

“But I want to stress that China and the U.S., as world’s largest developing and developed countries, shoulder major responsibilities in safeguarding world peace, stability and security and driving world development,” the spokeswoman added.

“The sustained, sound and steady growth of China-U.S. relations serves the fundamental and long-term interests of the two countries and benefits the world. We hope and believe that the U.S. government will pursue a positive policy toward China in a responsible manner.”

The comments came as Wang Yi, the Chinese foreign minister, is holding talks in Washington that include U.S. concerns about a Chinese military buildup on disputed islands in the South China Sea, and cooperation on dealing with North Korea’s nuclear and missile provocations.

Hua said Wang and Secretary of State John Kerry agreed the two sides will enhance cooperation and increase talks and exchanges.

(via The Free Beacon)

Romney: ‘Bombshell’ May Lurk in Trump’s Taxes,’

“We have good reason to believe that there’s a bombshell in Donald Trump’s taxes,” Mitt Romney said in Fox News interview Wednesday evening.

“I think there is something there,” Romney continued.

“Either he is not anywhere near as wealthy as he says he is or he hasn’t been paying the kind of taxes we would expect him to pay or perhaps he hasn’t been giving money to the vets or the disabled like he has been telling us he’s been doing”

“The reason I think there is a bombshell in there is because every time he is asked about his taxes he dodges and delays and says well we’re working on it; hey, we’re not talking about the taxes that are coming due this year, we are talking about taxes already filed, back taxes”

“He likes to tell people how well he’s done, why isn’t he willing to let us look at the tax return”: Romney finished.

Wednesday, February 24, 2016

Goldman Bankster Leaves Firm Amidst Brewing Scandal

|

| Tim Leissner |

Tim Leissner has left the Goldman Sach as the bank tries to distance itself from the scandal surrounding Malaysia’s prime minister and the firm 1MDB, which is the country’s troubled state investment fund.

Leissner was the driving force behind Goldman’s involvement in a series of controversial bond deals for the fund. He took personal leave in January, now he is gone rom thefirm.

According to FT, Leissner spent more than a decade of his 18-year career with the bank in Asia, taking a series of jobs in Singapore and Hong Kong and ultimately being named chairman of the bank’s Southeast Asia division in July 2014.

His close relationships with power brokers in Kuala Lumpur, including Malaysia’s prime minister, Najib Razak, who chairs 1MDB’s advisory board, produced what one close observer has described as a “golden period” for Goldman.

Najib’s critics allege, according to FT, that more than $680 million paid into his personal bank account was linked to 1MDB. Both Najib and 1MDB deny they are guilty of any crimes.

Malaysia:

FT reports that Goldman earned unusually large fees underwriting a series of bonds in 2012 and 2013 for the investment fund. The biggest deal was worth $3bn and earned the bank $300m — a fee many times the standard rate.

Goldman confirmed today that Leissner had left, but declined to comment further.

Do Americans Today Have More Servants Than Did J.D. Rockefeller?

By Don Boudreaux

Warren Meyer, having read my recent post on the likelihood that a randomly chosen middle-class American of today is materially richer than was the richest American of 100 years ago, e-mails to remind me of this post of his from 2007. Do read all of Warren’s superb post. It supplies excellent evidence that we ordinary Americans today are indeed materially richer than were American billionaires of a mere century ago.

I take this opportunity to address a criticism of my post that has arisen in different places and in a variety of ways. That criticism (as I summarize it) is that J.D. Rockefeller in 1916, compared to an ordinary American of 2016, could buy and “control” the services of many more people – specifically, workers and servants.

Overlook the fact that J.D. Rockefeller could no more “control” the services of a servant or worker than could a middle-class American of 1916. Rockefeller did indeed have the money to contract for the labor services of many people, but those contracts were mutually agreeable: Rockefeller had no slaves. (In Ron Chernow’s 1998 biography of Rockefeller – Titan – Chernow at one point expresses his surprise that Rockefeller’s employees seemed genuinely fond of him. Chernow is surprised because Rockefeller’s business rivals were decidedly not fond of him. Chernow missed the fact that Rockefeller’s actions – his vigor at competing against rivals and his good treatment of his employees – are precisely the sort of actions that we expect in genuinely competitive markets.)

A larger point is this one: each ordinary American today has working for him or her literally several hundred million people; actually, the number is more likely in the billions. As with Rockefeller, these servants of ours are our servants only through voluntary contracting. Of course, we know almost none of our servants personally. But the countless people who put forth the effort, intellectual and manual, to build the dwelling in which you live, the other group of countless people who worked to supply you with the food you ate today, and yet a third group of countless people who labored to produce the pencil that you used yesterday to scribble your grocery list – these countless people are in a very real way our servants no less than were the butlers, valets, cooks, and gardeners who attended to J.D. Rockefeller and his family.

The big difference between us today and Rockefeller is that, thanks to globalization, each of us has many more servants working for us than he had –and, unlike many of Rockefeller’s servants, very few of ours need by physically present in our homes and, therefore, they do not intrude on our privacy.

The above originally appeared at Cafe Hayek.

Paul Krugman on Reports That "I had to leave Princeton because of my drunken brawls with colleagues"

He writes:

-RW

One fun thing about being a public figure is hearing some of the rumors about the terrible, terrible things you’ve done. There was my personal bankruptcy; then, how I had to leave Princeton because of my drunken brawls with colleagues. I thought that was as good as it was going to get. But now I’m hearing that I’ve received lavish favors from Donald Trump, including stays at his properties and gaming chips.

I gotta say, this imaginary villain sounds a lot more interesting than the real guy.But he didn't fluff off this one.

-RW

Trouble For Uber, Lyft; Banned From Newark Airport

Is this the start of more serious trouble for Uber and Lyft? The Newark taxi associations has clearly gotten to Newark officials.

NyPo reports:

NyPo reports:

Newark officials said Tuesday that they will make good on their threat to ban Uber cars from Newark Airport.-RW

City officials said they will start penalizing any Uber or Lyft cars that try to pick up passengers at the Newark Airport terminals as of Tuesday. The city also plans to ban ride-share cars at Newark’s Penn train station.

The city first threatened the ban last week but then briefly backed off. It announced Tuesday that the ban was back on and would go into effect immediately.

Uber officials said they have asked the city officials to meet with them many times but were always rejected.

“We do not know why the city of Newark has flip-flopped and decided to once again target Uber despite the fact that more than 2,000 of the city’s residents depend on the app to make ends meet,” said Uber spokesman Matt Wing.

“We hope that Newark will again consider following the lead of the Port Authority and support the thousands of New Jersey residents who rely on Uber to earn income and the travelers who move through the airport every day.”

A Comment on Kurzweillian Exponential Growth

Here are some initial reactions to a 2001 paper by Raymond Kurzweil where he discusses a theory he has developed which he calls The Law of Accelerating Returns. I want to point out these are my initial thoughts and I haven't read any of Kurzweil's other works so it is quite possible upon further thought and more reading of Kurzweil that I may significantly change my views expressed below.

-RW

By The Law of Accelerating Returns Kurzweil means that:

It is difficult to understand how he reaches this conclusion since most technological advancement can not be measured in terms of given units. The advance from black and white televisions to color to the advancement of remote controls are all advancements in televisions but how does one measure in any kind of unit the advance from black and white televisions to remote control televisions?

The best we can say is that there has been spectacular change without putting a specific rate of change in terms of any unit on it---something that is necessary for Kurzweil to do to make his claim that technological growth is exponential and thus always accelerating.

To be sure, some advances are measurable in units. The elevator in my office building is state of the art, it will take you from the ground floor to the 20th floor in seconds and you hardly notice you are moving. This is a much faster ride than the elevators in buildings down the street that were built decades earlier.The travel time difference between the sets of elevators could be measured, and for certain there is a remarkable increase in speed. But should we expect technology to always advance in every way at an exponential rate? Will elevator speed increase at an exponential rate over the next 10 years? I guess it is possible, but I don't see why it necessarily will.

Modern man has an edge in future growth because for the most part technological progress has not been lost (forgotten), so every generation doesn't have to reinvent the wheel or the internet or the microchip or the cell phone. This aids in growth. You can build upon what you know. So in many ways, there is a reason to be nearly as optimistic as Kurzweil, but there are potential stumbling blocks that Kurzweil doesn't appear to recognize.

First, and most plausible, there may be stumbling blocks to certain future advancements that require a long time to solve (if ever). Just because a person knows addition, subtraction, multiplication, division, differential calculus and multivariable calculus doesn't mean he is about to advance to proving the Pollock tetrahedral numbers conjecture.

A second problem is, of course, the possibility of a tragic technological step that reverses if not destroys advancement of the driver of technological advance: human beings. What if a scientist experimenting and attempting to make the next major advance, in say the biological field, instead accidentally creates a deadly virus that wipes out the human species? What if a bad actor because of advancing technology is able to create a nuclear bomb that can blow up the planet?

Finally, Kurzweil appears to keep his Law of Accelerating Returns in a sterile environment where changes in society are not considered an element that can impact technological advancement.

However, anyone who visited the Soviet Union before it collapsed would surely recognized how an oppressive society can suffocate and reverse technological advance. Hell, anyone driving through the burnt out South Bronx in the 1970s could recognize how regulations (in this case rent controls) could halt advance and reverse it,

In summary, Kurzweil's absolutist optimism for exponential growth in the future has many problems. The first being that most growth can not be measured in terms so that it can be properly declared that all growth is indeed exponential. And although technological advancement has been dramatic, it is not at all clear that it has been across the board exponential and that it must be exponential. It is clear that there are a number of other elements that could slow advancing technology or even reverse it, from experiments gone bad to oppressive states to difficult scientific problems that won't be readily solved. Indeed, a new Dark Age can not be ruled out.

As for Kurzweil's additional step of considering a world of singularity, that is, a world that includes the merger of biological and nonbiological intelligence, immortal software-based humans, and ultra-high levels of intelligence that expand outward in the universe at the speed of light. It's a fun thought experiment where one could point to how things could go wrong in hundreds of different ways or turn in a hundred other directions but I think we will have some time to think about this, exponential growth or not.

(Note: The thinking of Kurzweil was first brought to my attention durinmg a series of conversations with Dr.Michael Edelstein, a recent column by Dr. Gary North reinforced the idea that I should take a look at Kurzweil's writing.)

-RW

By The Law of Accelerating Returns Kurzweil means that:

[T]echnological change is exponential, contrary to the common-sense “intuitive linear” view. So we won’t experience 100 years of progress in the 21st century — it will be more like 20,000 years of progress (at today’s rate). The “returns,” such as chip speed and cost-effectiveness, also increase exponentially. There’s even exponential growth in the rate of exponential growth. Within a few decades, machine intelligence will surpass human intelligence, leading to The Singularity — technological change so rapid and profound it represents a rupture in the fabric of human history. The implications include the merger of biological and nonbiological intelligence, immortal software-based humans, and ultra-high levels of intelligence that expand outward in the universe at the speed of light.It is true that there is no linear rate of progress, however, Kurzweil seems to hold the view that instead progress is always exponential in some sort of measured manner.

It is difficult to understand how he reaches this conclusion since most technological advancement can not be measured in terms of given units. The advance from black and white televisions to color to the advancement of remote controls are all advancements in televisions but how does one measure in any kind of unit the advance from black and white televisions to remote control televisions?

The best we can say is that there has been spectacular change without putting a specific rate of change in terms of any unit on it---something that is necessary for Kurzweil to do to make his claim that technological growth is exponential and thus always accelerating.

To be sure, some advances are measurable in units. The elevator in my office building is state of the art, it will take you from the ground floor to the 20th floor in seconds and you hardly notice you are moving. This is a much faster ride than the elevators in buildings down the street that were built decades earlier.The travel time difference between the sets of elevators could be measured, and for certain there is a remarkable increase in speed. But should we expect technology to always advance in every way at an exponential rate? Will elevator speed increase at an exponential rate over the next 10 years? I guess it is possible, but I don't see why it necessarily will.

Modern man has an edge in future growth because for the most part technological progress has not been lost (forgotten), so every generation doesn't have to reinvent the wheel or the internet or the microchip or the cell phone. This aids in growth. You can build upon what you know. So in many ways, there is a reason to be nearly as optimistic as Kurzweil, but there are potential stumbling blocks that Kurzweil doesn't appear to recognize.

First, and most plausible, there may be stumbling blocks to certain future advancements that require a long time to solve (if ever). Just because a person knows addition, subtraction, multiplication, division, differential calculus and multivariable calculus doesn't mean he is about to advance to proving the Pollock tetrahedral numbers conjecture.

A second problem is, of course, the possibility of a tragic technological step that reverses if not destroys advancement of the driver of technological advance: human beings. What if a scientist experimenting and attempting to make the next major advance, in say the biological field, instead accidentally creates a deadly virus that wipes out the human species? What if a bad actor because of advancing technology is able to create a nuclear bomb that can blow up the planet?

Finally, Kurzweil appears to keep his Law of Accelerating Returns in a sterile environment where changes in society are not considered an element that can impact technological advancement.

However, anyone who visited the Soviet Union before it collapsed would surely recognized how an oppressive society can suffocate and reverse technological advance. Hell, anyone driving through the burnt out South Bronx in the 1970s could recognize how regulations (in this case rent controls) could halt advance and reverse it,

In summary, Kurzweil's absolutist optimism for exponential growth in the future has many problems. The first being that most growth can not be measured in terms so that it can be properly declared that all growth is indeed exponential. And although technological advancement has been dramatic, it is not at all clear that it has been across the board exponential and that it must be exponential. It is clear that there are a number of other elements that could slow advancing technology or even reverse it, from experiments gone bad to oppressive states to difficult scientific problems that won't be readily solved. Indeed, a new Dark Age can not be ruled out.

As for Kurzweil's additional step of considering a world of singularity, that is, a world that includes the merger of biological and nonbiological intelligence, immortal software-based humans, and ultra-high levels of intelligence that expand outward in the universe at the speed of light. It's a fun thought experiment where one could point to how things could go wrong in hundreds of different ways or turn in a hundred other directions but I think we will have some time to think about this, exponential growth or not.

(Note: The thinking of Kurzweil was first brought to my attention durinmg a series of conversations with Dr.Michael Edelstein, a recent column by Dr. Gary North reinforced the idea that I should take a look at Kurzweil's writing.)

Subscribe to:

Posts (Atom)

Actually I believe youre perpetuating a myth Robert. This can be true ONLY if the demand for gold is below that of other goods and commodities in the market. You and Gary North should be aware of this.

Gold has a special HISTORIC, and not a priori, aspect to its market perception versus other goods. If the economy is tanking, not because of inflation, and people find gold to contain a sense of security and thus a "premium" over holding dollars, I would consider this a demand-side ordeal and thus not inflation in the current sense youre talking about.