Consumer spending fell to an estimated $50.9 billion over the weekend, down from $57.4 billion in 2013, according to the National Retail Federation. The average shopper spent an estimated $380.95 over the weekend, a 6.4 percent drop, according to an NRF-commissioned survey of more than 4,600 people by Prosper Insights & Analytics.

“The holiday season and the weekend are a marathon not a sprint,” NRF Chief Executive Officer Matthew Shay said on a conference call. “This is going to continue to be a very competitive season.”

The Washington-based NRF had predicted that 140.1 million shoppers would visit retailers this weekend, a small decline from last year’s 140.3 million. Instead, only 133.7 million showed up -- despite many stores extending their hours during Thanksgiving to boost sales.

Online sales on the other hand were up strong, though far from closing the gap from lower in-store saels. Thursday-Friday numbers from Channel-Adviser showed 22% growth online. According to Adobe Systems Inc Thanksgiving and Black Friday sales were at an all-time high of $1.33 billion.

Sunday, November 30, 2014

How to Install Your SIM Card In An Amazon Fire Phone

Here's my public service announcement for 2014.

__

Robert Wenzel

LikedIn Profile

Blogger Profile

Amazon Books

I have been looking at new smartphones the last few months, planning to upgrade. With Amazon discounting their Fire Phone to $199 (and their throwing in a one year subscription to Amazon prime on top of it), I decided to buy it.

With three days of use, I am very happy with it. As with all new smartphones, there is a learning curve and so it will probably be awhile be for I understand many of the functions incorporated.

That said, here is the one thing you need to know about the phone from the outset: How to put the damn sim card into the phone. I'm guessing that this won't be a problem for Apple phone users, since the Fire is designed along the lines of an iPhone.

But if you have been, like me, an Android phone user, the sim card installation will be a different experience and not at all intuitive,

First, unlike any cell phone I have used before, the Amazon requires a nano sim card. This is a much smaller card. So if you are planning to simply switch your sim into your new Fire, you are going to have to go to your provider's store and get it clipped to nano size.

Alternatively, you can buy a sim card cutter to cut your card down to nano size, yourself.

Now, here is the tricky part that will save you many calls to your phone provider: How to insert the sim card into your phone. It took me three calls to T-mobile customer service before I could get someone that provided me with this basic information:

To install the sim card, you need to pull out the tray (with the small hole) that is on the side of the Fire. You can pull this out by using the tool provided with your phone or with a paper clip. In either case, slip the prong into the hole and pull the tray out.

Here's what will take you three phone calls to get an answer to:

1. The sim card should be placed on the tray with the gold part facing down

2. The indentation in the card should be placed on the tray so that it is facing away from the phone, when it is slipped back in.

Viola! You are ready to go. These two steps seem obvious, but there is nothing on the tray that will intuitively signal you about these two steps, which makes for multiple incorrect options.

One more point about the sim card itself. For those of you are going to be buying a new sim card, rather than using a current sim, I noticed that Walgreens sells ATT nano sim cards for $10.00.

You can also buy them online at Amazon, here. (I believe this is pre-pay only).

If you don't already have a contract but want one from ATT, you can get a contract phone here.

If you already have a contract and want to switch, you can buy the Fire here. Note: The phone works with ATT, T-Mobile,Walmart Family Mobile, MetroPCS, Brightspot, Simple Mobile, Mobal, Net10, Straight Talk, h20 Wireless, and OneSimCard.

But it is not compatible with Verizon, Sprint, and US Cellular.

__

Robert Wenzel

LikedIn Profile

Blogger Profile

Amazon Books

Best Consumer Complaint, Ever

The video complaint apparently worked. Jane Stewart writes:

The hilarious song significantly damaged the airline’s reputation and eventually spurred United’s customer relations department into action

A Valuable New Book on Energy Trading Tenets

Gaurav Sharma, a Forbes columnist, is out with an extremely insightful review of the book, Energy Trading and Risk Management, by EPJ friend Iris Mack, here.

The Remarkable Increase in Sales of US Mint Silver Eagle Sales

The price of gold and silver have recently been weak, but this doesn't mean there are no buyers. The buyers are very strong holders. Rather than the metals being accumulated through ETFs (which can include hot money that will flow in and out quickly), holders are often individuals who take direct possession of physical coin. These people will not sell simply because of a minor uptick (and most won't sell during a major uptick), this means the price will be able to advance very rapidly because of limited overhead resistance.

Below is the chart of the remarkable increase in purchases of US Mint direct physical silver purchases via silver eagles.

Below is the chart of the remarkable increase in purchases of US Mint direct physical silver purchases via silver eagles.

Here Come the 2015 Health Insurance Premium Hikes (Thank You Obama)

.Here is a sample list of the rate increases the biggest market share carriers are asking for:

(via Health Care Policy and Marketplace Review)

(via Health Care Policy and Marketplace Review)

BREAKING: SwissGold Referendum Shot Down in Flames

The Swiss have rejected the “Save Our Swiss Gold” voter referendum that would have required the Swiss National Bank to:

– hold at least 20% of its reserves in gold;

– repatriate of all of its gold currently held outside its borders; and

– ban selling any of its gold.

Louis Cammarosano at Smaulgld writes:

UPDATE

The final vote is in: 78% voted against the referendum.

– hold at least 20% of its reserves in gold;

– repatriate of all of its gold currently held outside its borders; and

– ban selling any of its gold.

Louis Cammarosano at Smaulgld writes:

Swiss Voters Hand Swiss National Bank a Blank Check and More Toner for Their Franc Printing Press

Because the Save our Swiss Gold initiative was rejected, it means that the SNB can continue their misguided policy of printing Swiss Francs to buy Euro denominated debt in order to support the Franc:Euro peg of 1.2:1.

By buying Euro denominated debt, the Swiss in effect have been and will continue to be supporting the deficit spending of the Euro zone.

The European Central Bank (ECB) is considering its own round of quantitative easing (QE). If the ECB were to embark in its own QE program, Switerland, unfettered by any gold reserve requirements will have to go along on the disasterous journey and continue to print Francs in order to prevent the Franc from appreciating against the Euro.

Gold rises as a hedge against inflation – defined as an increase in the money suppply. The Swiss No vote on the Save Our Swiss Gold vote ensures that the SNB may now continue their Franc printing and if necessary increase it unfettered by any gold reserve requirement.

UPDATE

The final vote is in: 78% voted against the referendum.

Eight States Where Gas Will Drop Below $2

As the oil price continues to fall, consumers in some states may see gas below $2.00 per gallon.

The states likely to post sub- $2 gas are near large refineries, and have low state gas taxes.

The eight states are are Mississippi, Alabama, Louisiana, Texas, Oklahoma, South Carolina, Missouri, and Tennessee.

(via 24/7)

Saturday, November 29, 2014

Gary North's Interview of Friedrich A. Hayek

There is nothing better than when an interesting person is interviewed by someone who asks the right questions. That's what happened when Gary North interviewed Nobel Prize winning economist Friedrich Hayek:

HOT India Eases Import Restriction on Gold

In a surprise move, bullish for gold, India on Friday ended one of the restrictions on gold imports put in place last year to reduce the country's chronic current-account deficit.

The Reserve Bank of India said the government had decided to end the requirement that gold importers be able to prove that at least 20% of the precious metal they brought into the country would become jewelry exports. Gold prices in India and gold smuggling shot up, as imports dwindled as a result.

The restriction, dubbed the "20:80 rule," was adopted in August 2013 to keep India's widening current-account deficit in check. "It has been decided by the government of India to withdraw the 20:80 scheme and restrictions placed on import of gold," the central bank said.

India is the world's second-largest consumer of gold, which is traditionally used for jewelry and as one of the main sources of savings in the country where hundreds of millions of people do not have bank accounts.

The Reserve Bank of India said the government had decided to end the requirement that gold importers be able to prove that at least 20% of the precious metal they brought into the country would become jewelry exports. Gold prices in India and gold smuggling shot up, as imports dwindled as a result.

The restriction, dubbed the "20:80 rule," was adopted in August 2013 to keep India's widening current-account deficit in check. "It has been decided by the government of India to withdraw the 20:80 scheme and restrictions placed on import of gold," the central bank said.

India is the world's second-largest consumer of gold, which is traditionally used for jewelry and as one of the main sources of savings in the country where hundreds of millions of people do not have bank accounts.

Amazon Deals This Week

Price Inflation in San Francisco vs. Detroit and the US CPI

Fed printed money is flowing big time in the Silicon Corridor and the price inflation data shows it. It is well above Fed "target" inflation.

(via Matthew B.)

For more on Fed targeting SEE: Is Milton Friedman the Direct Cause of the Current Crazed Fed "Inflation Targeting"?

(via Matthew B.)

The Deflation That Paul Krugman Fears

BLACK FRIDAY 1996: Packard Bell Computer for $1,467 with NO Monitor ($2,200 in 2014 dollars)

Windows 8.1

Windows 8.1

4GB Memory

4GB Memory

500GB Hard Drive

(via Mark Perry)

In Paul Krugman's world 1996 was a better place, compared to this:

$399.99

Intel® Celeron® Processor (Dual Core)Windows 8.1

Windows 8.1

4GB Memory

4GB Memory

500GB Hard Drive

(via Mark Perry)

EU Government Is A Monopoly, Not Google

By Ilana Mercer

The economic sluggards of Europe don't much like competition; it's too much like hard work.

Competition means that a business has to please the only real boss: a picky customer with many

options. Google has raised the ire of the European competition and its proxy, the European Parliament,which "overwhelmingly backed a motion urging antitrust regulators to break up Google."

"Google's dominance," writes Jörg Brunsmann for DW, "didn't arise from the company employing unfair measures to push its competitors out of the market. It's become a market leader because of its innovation."

Put more precisely: Google has arrived at its market share by pleasing search-engine users.

I was part of a worthy group of Austrian economists who published "The Microsoft Corporation In Collision With Antitrust Law," in The Journal of Social, Political and Economic Studies (Winter 2001, Vol. 26, No. 1.). In section (4) for which I was responsible ("Economic Freedom, Monopoly and the Government,"), I wrote:

The principle applies to Google.

In Austrian economics, moreover, a large market share does not a monopoly make. "The only true

monopolies are government monopolies. A company is a monopoly only when it can forcibly prohibit competitors from entering the market, a feat only ever made possible by state edict. In a truly free market, competition makes monopoly impossible." (From "Media Concentration Is Not A Threat to Free Expression, Government Is.")

Contributor Ilana Mercer is a paleolibertarian writer, based in the U.S. She is a contributor to

Junge Freiheit, a German weekly of excellence, and is a fellow at the Jerusalem Institute for

Market Studies. Her latest book is “Into the Cannibal’s Pot: Lessons For America From Post-Apartheid South Africa.” Her website is www.IlanaMercer.com. Follow her on Twitter. “Friend” her on Facebook.

The economic sluggards of Europe don't much like competition; it's too much like hard work.

Competition means that a business has to please the only real boss: a picky customer with many

options. Google has raised the ire of the European competition and its proxy, the European Parliament,which "overwhelmingly backed a motion urging antitrust regulators to break up Google."

"Google's dominance," writes Jörg Brunsmann for DW, "didn't arise from the company employing unfair measures to push its competitors out of the market. It's become a market leader because of its innovation."

Put more precisely: Google has arrived at its market share by pleasing search-engine users.

I was part of a worthy group of Austrian economists who published "The Microsoft Corporation In Collision With Antitrust Law," in The Journal of Social, Political and Economic Studies (Winter 2001, Vol. 26, No. 1.). In section (4) for which I was responsible ("Economic Freedom, Monopoly and the Government,"), I wrote:

Antitrust legislation considers a large market share or a concentration in the market to

signify both monopoly and predatory practices on the part of a company. As such, the antitrust chimera is based on discredited theories about competition. Relying as it does on a model of ideal or perfect rather than rivalrous competition, the legislation aims at a market neatly carved among competitors(32).

The principle applies to Google.

In Austrian economics, moreover, a large market share does not a monopoly make. "The only true

monopolies are government monopolies. A company is a monopoly only when it can forcibly prohibit competitors from entering the market, a feat only ever made possible by state edict. In a truly free market, competition makes monopoly impossible." (From "Media Concentration Is Not A Threat to Free Expression, Government Is.")

Contributor Ilana Mercer is a paleolibertarian writer, based in the U.S. She is a contributor to

Junge Freiheit, a German weekly of excellence, and is a fellow at the Jerusalem Institute for

Market Studies. Her latest book is “Into the Cannibal’s Pot: Lessons For America From Post-Apartheid South Africa.” Her website is www.IlanaMercer.com. Follow her on Twitter. “Friend” her on Facebook.

Economist Who Attacked Austrian Economics for Considering a Recession as "Necessary Punishment," is into "Necessary Punishment" on a Personal Level

NYT columnist Paul Krugman, in the past, has attacked Austrian School economics because, according to him, it is stuck in a morality play that believes that pain must be paid following a boom. This is a decidedly distorted way to look as Austrian theory, but Krugman likes to smear. (SEE: The Strange Mind of Nobel Laureate Paul Krugman)

Indeed, he has written that Austrian theory is

the idea that slumps are the price we pay for booms, that the suffering the economy experiences during a recession is a necessary punishment for the excesses of the previous expansion...I regard [Austrian Theory] as being about as worthy of serious study as the phlogiston theory of fire... It turns the wiggles on our charts into a morality play, a tale of hubris and downfall. And it offers adherents the special pleasure of dispensing painful advice with a clear conscience, secure in the belief that they are not heartless but merely practicing tough love.Naturally, he has objected to this morality view picture that he paints, curiously, though, he lives a personal pain and suffering drama of his own. Two days a week!

He writes at NYT:

[A]t the severe risk of providing too much information — I have some recent experience along those lines. Yes, I’ve lost a fair bit of weight over the past two years (no special forcing event, just the approach of the big six-oh), and learned a few things about myself along the way...I know as much about diets as Krugman knows about Austrian economics, but it appears to me he is into his own little weekly pain and suffering drama that makes no sense from a health and nutrition perspective. What gives with this guy?

[W]hat has worked for me is severe caloric restriction two days a week. In case you’re wondering, it’s actually very unpleasant. But periodic suffering seems to suit my personality.

Uber Banned in Vegas

Hookers are welcome in Vegas, but not Uber. Taxi oligarchs are starting to show their political muscle.

A Nevada judge has ordered Uber to stop doing business Las Vegas— and the rest of the state.

Uber, rather than keep taking rides while appealing the Washoe County District Court judge’s ruling, stopped operations Nevada in the city.

“On the eve of Thanksgiving — when Nevadans should be celebrating with family, many are now worried about how they’re going to pay their bills,” Uber said, referring to its 1,000 drivers in the state.

Uber said it will fight the ban and has already collected more than 18,000 signatures on a petition to demand its re-entry into the state.

The Nevada ruling comes 48 hours after Uber — and rival Lyft — were banned from picking up passengers at the Louisville (Ky.) Airport.

The company is also facing a possible ban in France.

EPJ Week In Review - Week Ending 11/28/14

Below you'll find everything that has been published on EPJ for the week ended Friday November 28, 2014. The hottest posts for each day are highlighted in red.

- OPEC Decides Against Production Cuts

- FOR SALE Bankster Townhouse: $8 Million

- New Supersonic Jet to Travel from New York to LA in 2.5 Hours

- This is What Happens When You Put All Kinds of Restrictions on Employment

- Prepare for Lower Gasoline Prices: The Crude Oil Plunge Following OPEC's Decision Not to Cut Prices

- Thanksgiving Online Sales Up 20.1%

- Breaking Down the 2015 US Workforce

- Get a Degree in Drones: Earn $100,000 a Year

- Financial Terrorists On The Road—–Krugman And Rogoff Peddling Toxic Advice

- James Watson to Sell Nobel Prize Medal

- The Great Thanksgiving Hoax

- Top Citigroup Economist Attacks Swiss Gold Referendum

- The Austrian Theory of the Business Cycle

- In Your Thanksgiving Face

- Coupons, Coupons and More Coupons

- The State of Federal Reserve Money Manipulations

- Oil Break-Even Prices

- 8 Steps to Finding Your Next Job

Wednesday 11/26/14

- David Stockman: Why Crony Capitalism Will Be Hard To Uproot

- Housing Price to Rent Ratio

- Amazon Cuts Fire Phone Price Ahead of Holidays

- Talking Turkey

- Angelina Jolie Attacks 'Mansion Tax' Plan

- The Daughter of a Bankster Wants Tips on Finding Crimes

- How Much of Your Thanksgiving Meal Will Have Been Spent on Politics This Year?

- Go Ahead Keep Raising the Minimum Wage: Here Comes DyRoS, the Humanoid Robot

- Tyler Cowen on the Swiss Gold Referendum

- "The Shale Revolution Doesn't Work At $80"

- Prime Time for Ferguson

- PETER SCHIFF: All eyes should now be focused on the Swiss voters

- Exploding Military Spending in Africa

- Tim Geithner's Incredible Eye for Talent

- The U.S. Has Seen the Strongest Six-Month Expansion in GDP in More Than a Decade BUT...

- It Has Only Begun: Nearly 120 Protests over Ferguson Decision Planned

- Venture Capital is Pouring Money into Minimum Wage Law Defeating Robots

- Is Milton Friedman the Direct Cause of the Current Crazed Fed "Inflation Targeting"?

- The People's Republic of San Francisco is Now Micro-Managing Employee Schedules of Chain Stores

- The Attorney General Nominee as Bandit

- Marxist Receives Writing Award (It's not what you think)

- Does Paul Krugman Believe He Has Conquered Death?

- Industries with the Highest Employment Concentrations: Large Metro Areas

- Peter Schiff: Why Gold Will Rise And Exceed Previous Highs; Destroys Inflationist Advocates

- New Bill Passed: Did This Just Happen in the Land of the Free?

- For the Paul Krugman File

- Is Bitcoin "Creator" Satoshi Nakamoto an NSA Agent?

- What Kind of Specializations Do Female Hard Science PhD Candidates Focus On?

- Gary North on Karl Marx

- How Janet Napolitano is Using University of California Students as Pawns in a Money Power Play

- How Government Officials are Using Bank Regulations to Shutdown Industries

- Walter Block: The Errors of Friedman, Coase & Buchanan

- 30 Buildings That Are Going to Radically Change the NYC Skyline

- The Cleveland Financial Stress Index

- The First Female Fed Inflationist is Dead

- The New Real Estate Bubble: A 275-Square-Foot Microflat in Hong Kong Sold for $722,000

- Company Unveils RocketSkates

- Is There Really Much Difference Between The Two Political Parties?

- European Parliament Call for the Breakup of Google

- Ron Paul on Obamacare and the “Stupid” People

- Interesting Research Using Twitter; The Unemployed Get Up Late And Can't Spell

- What a Ukrainian Financial Meltdown Might Look Like

- HOT Peter Schiff Responds to Attack from Paul Krugman

TOMORROW: Switzerland's Gold Referendum Set For Vote

All poll indications that I have seen indicate the referendum will not pass.

Friday, November 28, 2014

James Watson to Sell Nobel Prize Medal

James Watson, the biologist who has been shunned by the scientific community after linking intelligence to race, plans to sell the Nobel Prize medal he won in 1962 for discovering the structure of DNA, reports FT.

Auction house Christie’s said the gold medal, the first Nobel Prize to be sold by a living recipient, could fetch as much as $3.5m when it is auctioned in New York next Thursday.

FT continues:

Auction house Christie’s said the gold medal, the first Nobel Prize to be sold by a living recipient, could fetch as much as $3.5m when it is auctioned in New York next Thursday.

FT continues:

If the medal is sold Mr Watson said he would use some of the proceeds to make donations to the “institutions that have looked after me”, such as University of Chicago, where he was awarded his undergraduate degree, and Clare College, Cambridge.Watson – who insisted he was “not a racist in a conventional way” – said it had been “stupid” of him to not realize that his comments on the intelligence of African people would end up in an article.

Mr Watson said his income had fallen following his controversial remarks in 2007, which forced him to retire from the Cold Spring Harbor Laboratory on Long Island, New York. He still holds the position of chancellor emeritus there.

“Because I was an ‘unperson’ I was fired from the boards of companies, so I have no income, apart from my academic income,” he said.

He would also use some of the proceeds to buy an artwork, he said. “I really would love to own a [painting by David] Hockney”.

Francis Wahlgren, the Christie’s auctioneer who is handling the sale of the medal, said he was confident it would fetch the $2.5m reserve. He said demand for memorabilia associated with genetic discovery had “exploded” in recent years as the promise of biotechnology became apparent.

Financial Terrorists On The Road—–Krugman And Rogoff Peddling Toxic Advice

By David Stockman

Here are a couple of reasons why Keynesian economists are truly a menace in today’s bubble ridden and debt-impaled world. It seems that both Harvard’s Kenneth Rogoff and Princeton’s Paul Krugman are on the global advice circuit, peddling what amounts to sheer snake oil to desperate politicians and policy-makers who have already buried themselves—-so far to no avail—-in unprecedented waves of fiscal and monetary “stimulus”.

But never mind. The professors have a three part solution, and its more, more……and moar! To make room for more monetary stimulus after six-years at the zero bound, therefore, Professor Rogoff has a truly juvenile solution. Namely, to abolish cash. That’s right, this Harvard windbag proposes to confiscate your kids’ piggy bank and any green stuff that may be left in your wallet.

Meanwhile, Krugman has

Get a Degree in Drones: Earn $100,000 a Year

There will be more than 100,000 new drone related jobs nationally by 2025 , according to a 2013 report by the Association for Unmanned Vehicle Systems International,

Dozens of universities are offering — or planning to offer — drone programs. “We don’t call them drones, we call them unmanned aircraft systems integration,” says Marty Rogers, director of the Alaska Center for Unmanned Aircraft Systems Integration at the Geophysical Institute, University of Alaska Fairbanks, according to MarketWatch.

There is even a university specializing in drones. “We keep inventing courses that have never been taught before,” says Jerry Lemieux, president of the Unmanned Vehicle University in Phoenix. Lemieux — a former Top Gun pilot in the U.S. Air Force and Delta 767 pilot — founded the school in 2012. It offers a certificate (4-credit course), Masters (9-credit course) and Ph.D. (12-credit course) for $1,600 per credit. The online courses range from the law surrounding drones to pilot training, which also involves two days at one of the university’s 10 flight schools. One recent graduate, he says, snagged a job as a UAV (unmanned aviation vehicle) analyst at an aviation manufacturing company in Florida earning $100,000 a year.

Thanksgiving Online Sales Up 20.1%

The first numbers are in on online sales this year.

According to ChannelAdvisor, Thanksgiving sales this year are up overall 20.1%.

According to ChannelAdvisor, Thanksgiving sales this year are up overall 20.1%.

Prepare for Lower Gasoline Prices: The Crude Oil Plunge Following OPEC's Decision Not to Cut Prices

OPEC is running a major squeeze play. At it's just finished meeting in Vienna,, it decided to not lower the production ceiling. This is will put tremendous pressure on the oil price. It will cause many US domestic high-cost oil shale producers to shutdown production.

Here's what happened in oil trading today:

Here's what happened in oil trading today:

New Supersonic Jet to Travel from New York to LA in 2.5 Hours

The N+2, designed by US global aerospace Lockheed Martin, is intended for commercial airlines, and aims to cut the travel time from New York to Los Angeles by half - from five hours to just 2.5.

The aircraft would accommodate 80 passengers and have a tri-jet configuration in which one engine is on top of the aircraft and the other two are under each wing to reduce sonic boom, reports The Telegraph.

Meanwhile, Airbus is teaming up with US-based Aerospace firm Aerion to create a supersonic jet that can fly from London to New York in three hours and from Los Angeles to Tokyo in six.

The Aerion AS2 private business jet will fly at 1,217mph, using proprietary supersonic laminar flow technology - almost as fast as Concorde, which flew at 1,350mph.

The cost of the AS2 is thought to be more than $100 million, according to The Telegraph and Aerion hopes test flights will begin by 2019.

The aircraft would accommodate 80 passengers and have a tri-jet configuration in which one engine is on top of the aircraft and the other two are under each wing to reduce sonic boom, reports The Telegraph.

Meanwhile, Airbus is teaming up with US-based Aerospace firm Aerion to create a supersonic jet that can fly from London to New York in three hours and from Los Angeles to Tokyo in six.

The Aerion AS2 private business jet will fly at 1,217mph, using proprietary supersonic laminar flow technology - almost as fast as Concorde, which flew at 1,350mph.

The cost of the AS2 is thought to be more than $100 million, according to The Telegraph and Aerion hopes test flights will begin by 2019.

FOR SALE Bankster Townhouse: $8 Million

The most expensive single-family townhouse in the East Village in NYC is about to hit the market, reports NyPo's Jennifer Gould Keil.

The townhouse has a bankster pedigree of sorts, as Mary-Kate Olsen and her much older bankster fiancé Olivier Sarkozy rented the place from 2012 to the fall of 2013.

Sarkozy is the brother Nicolas Sarkozy, the former president of France and is co-head and Managing Director of the Carlyle Group's Global Financial Services Group. He is also a member of the Board of Directors of BankUnited.

According to NyPo, Sarkozy and Olsen are now focused on renovating their $13.5 million Turtle Bay mansion, which comes with a rooftop exercise pool and built-in paparazzi-proof garage.

OPEC Decides Against Production Cuts

At a meeting in Vienna, Austria, the members of OPEC left the oil output ceiling at the previously set 30 million barrels per day.

This production level will continue to put short-term downward pressure on oil prices. Indeed, after Thursday’s decision was announced, ICE January Brent, the international oil benchmark, fell by $6.50 a barrel to $71.25, its steepest one-day fall since 2011.

The lower oil price will put major pressure on many oil producers, especially Libya, Venezuela and, domestically. US oil share operators. (SEE:"The Shale Revolution Doesn't Work At $80"). Ultimately, much marginal production will be shut down, setting the stage for the next oil advance. But, in the very short-term, the price will remain at very low levels.

(graphic via FT)

This production level will continue to put short-term downward pressure on oil prices. Indeed, after Thursday’s decision was announced, ICE January Brent, the international oil benchmark, fell by $6.50 a barrel to $71.25, its steepest one-day fall since 2011.

The lower oil price will put major pressure on many oil producers, especially Libya, Venezuela and, domestically. US oil share operators. (SEE:"The Shale Revolution Doesn't Work At $80"). Ultimately, much marginal production will be shut down, setting the stage for the next oil advance. But, in the very short-term, the price will remain at very low levels.

(graphic via FT)

Thursday, November 27, 2014

8 Steps to Finding Your Next Job

By Liz Ryan

The best way to get a new job is to apply for lots of jobs, and not to get emotionally attached to any of the opportunities. Plant a few seeds every day. Some of them will grow. Some will wither. You only care about the ones that bear fruit!

That doesn’t mean mindlessly lobbing applications and resumes into automated recruiting portals. That’s a waste of time. The best way to apply for a job is to

Oil Break-Even Prices

Only United Arab Emirates, Qatar and Kuwait are profitably producing most of their oil at current prices. A supply slowdown is coming.

The State of Federal Reserve Money Manipulations

Below is the percentage change in the US leading index, since 1982, via data from the Federal Reserve Bank of Philadelphia. Don't let anyone ever tell you the Federal Reserve money manipulations bring stability to the economy. It is a myth.

In Your Thanksgiving Face

Oh yeah, the makers of vacuum robots have sent out this tweet today:

The robots are coming that will defeat minimum wage laws. Dyson's vacuum robot can already 390 degrees around it.

Happy Thanksgiving from @Dyson. pic.twitter.com/KiSOTvdhxO

— Dyson (@Dyson) November 27, 2014

The robots are coming that will defeat minimum wage laws. Dyson's vacuum robot can already 390 degrees around it.

The Austrian Theory of the Business Cycle

This lecture by Roger Garrison was presented at the 2012 Mises University in Auburn, Alabama.

For more on business cycle theory, see Austrian School Business Cycle Theory by Murray Rothbard,

For more on business cycle theory, see Austrian School Business Cycle Theory by Murray Rothbard,

Top Citigroup Economist Attacks Swiss Gold Referendum

Citigroup Inc. Chief Economist Willem Buiter is out with a report advising that the initiative requiring the Swiss National Bank to hold a fixed portion of its assets in gold makes no sense,

“There is no economic or financial case for a central bank to hold any single commodity, even if this commodity had intrinsic value,” Buiter, a former Bank of England policy maker, wrote.

Thus, he completely ignores the fact that gold can not be printed at will by central bankers, which means that gold has inflation protection that a fiat currency could never have. And that is a pretty good reason to have a 100% gold standard.

“There is no economic or financial case for a central bank to hold any single commodity, even if this commodity had intrinsic value,” Buiter, a former Bank of England policy maker, wrote.

Thus, he completely ignores the fact that gold can not be printed at will by central bankers, which means that gold has inflation protection that a fiat currency could never have. And that is a pretty good reason to have a 100% gold standard.

The Great Thanksgiving Hoax

By Richard J. Maybury

Each year at this time, schoolchildren all over America are taught the official Thanksgiving story, and newspapers, radio, TV, and magazines devote vast amounts of time and space to it. It is all very colorful and fascinating.

It is also very deceiving. This official story is nothing like what

Each year at this time, schoolchildren all over America are taught the official Thanksgiving story, and newspapers, radio, TV, and magazines devote vast amounts of time and space to it. It is all very colorful and fascinating.

It is also very deceiving. This official story is nothing like what

Wednesday, November 26, 2014

"The Shale Revolution Doesn't Work At $80"

Drilling for oil in 19 shale regions loses money at $75 a barrel, according to calculations by Bloomberg New Energy Finance. Those areas pumped about 413,000 barrels a day, according to the latest data available from Drillinginfo Inc. and company presentations.

“Everybody is trying to put a very happy spin on their ability to weather $80 oil, but a lot of that is just smoke,” said Daniel Dicker, president of MercBloc Wealth Management Solutions with 25 years’ experience trading crude on the New York Mercantile Exchange. “The shale revolution doesn’t work at $80, period.”

“Everybody is trying to put a very happy spin on their ability to weather $80 oil, but a lot of that is just smoke,” said Daniel Dicker, president of MercBloc Wealth Management Solutions with 25 years’ experience trading crude on the New York Mercantile Exchange. “The shale revolution doesn’t work at $80, period.”

(via Zero Hedge)

Tyler Cowen on the Swiss Gold Referendum

The commander of Koch-funded economics, Tyler Cowen , lists three quite reasonable referendums that are up for vote in Switzerland:

For a more sound take on the gold Swiss referendum, see: PETER SCHIFF: All eyes should now be focused on the Swiss voters.

RW Note: The passage of the Swiss gold referendum would be a great thing, however, the last poll numbers I have seen suggest the referendum will not pass.

The most contentious may be one put forward by a group called Ecopop, which would limit immigration to 0.2 per cent of the resident population. That has alarmed businesses, who worry it would make it harder to hire skilled staff and sour relations with the EU, which is Switzerland’s largest export market.

Another initiative would force the central bank to hold 20 per cent of its assets in gold, as well as ban it from selling any of its holdings of the metal. Gold bug supporters say it would strengthen Switzerland’s independence but the central bank has warned it will make harder its job of ensuring economic stability.

And the third would scrap the system of tax privileges for wealthy foreigners that prompted such people as Michael Schumacher, German Formula 1 racing driver, and Ingvar Kamprad, Swedish Ikea founder, to call Switzerland home.And then declares:

I am hoping they all fail...

For a more sound take on the gold Swiss referendum, see: PETER SCHIFF: All eyes should now be focused on the Swiss voters.

RW Note: The passage of the Swiss gold referendum would be a great thing, however, the last poll numbers I have seen suggest the referendum will not pass.

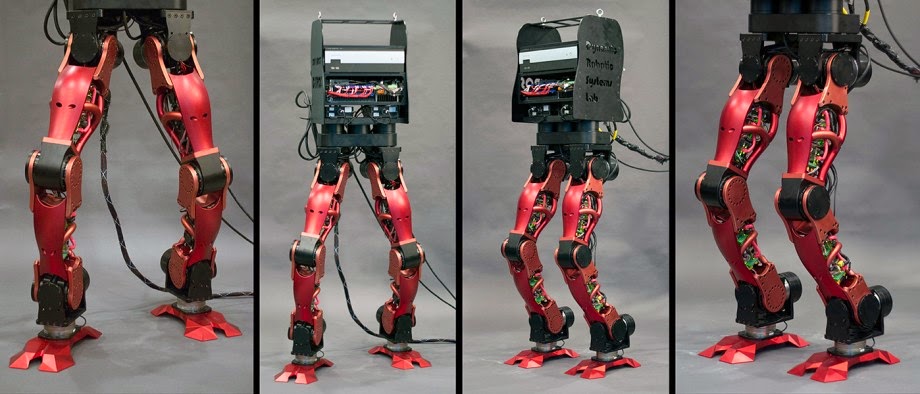

Go Ahead Keep Raising the Minimum Wage: Here Comes DyRoS, the Humanoid Robot

A collaborative interdisciplinary team has designed a full sized humanoid bipedal robot.

The robot has already been integrated into a contemporary Korean dance performance.

The next step say developers is to develop the upper body.

Let's see minimum wagers compete with this

(via DHRC)

The Daughter of a Bankster Wants Tips on Finding Crimes

The daughter of top bankster Jamie Dimon needs your help.

Just out of Columbia journalism school, Laura Dimon has landed a gig at the New York Daily News and is looking for assistance in finding criminal activity. She has tweeted out:

Just out of Columbia journalism school, Laura Dimon has landed a gig at the New York Daily News and is looking for assistance in finding criminal activity. She has tweeted out:

I just had this sent to her as a tip.

Angelina Jolie Attacks 'Mansion Tax' Plan

Actress Angelina Jolie is criticizing proposals for a so-called "mansion tax" in the U.K. that the Labour party has said it would introduce should it win a general election in 2015. Apparently she is considering buying one there.

The actress said that the party's plan to tax houses worth more than £2 million ($3.1 million) "could put me off" buying a home in the U.K. "I'm quite responsible about money," she said.

The rich hate to pay taxes just as much as everyone else. I'm glad to see Jolie being honest about it.

Talking Turkey

The most popular turkey product continues to be the whole turkey, comprising less than a quarter of all sales. However, many turkey products are tailor-made for today's consumers. As a result, several other turkey products are closing in on the whole bird's dominance in the marketplace. Ground turkey has experienced the largest sales growth among consumers in the last decade.

The top three turkey products sold in 2011 were whole birds, ground turkey, and cooked white meat (deli meat). Raw products, especially breast cuts, such as tenderloins and cutlets, also are seeing an increase in sales. In 2011, the average retail price for whole frozen turkeys in the United States was $1.58 per pound. The average person in the United States ate 16.1 pounds of turkey in 2011.

Exports

In 2012, 800 million pounds were exported. Exports now comprise more than 13 percent of total turkey production, compared with 1.2 percent in 1990. In 2010, the top four export markets for U.S. turkey meat were Mexico (399.0 million pounds), China (82.9 million pounds), Hong Kong (37.9 million pounds) and Canada (22.7 million pounds).

Top Turkey Producing States

Minnesota

North Carolina

Arkansas

Indiana

Missouri

Virginia

California

South Carolina

Pennsylvania

Ohio

(via National Turkey Federation)

Amazon Cuts Fire Phone Price Ahead of Holidays

Amazon has cut the price for its Fire smartphone just ahead of the Black Friday weekend as it seeks to sell a lot of slow-moving inventory. The phone is now available for $199 without a carrier contract. That price includes a one-year Prime membership, which typically costs $99 a year. That's a $250 price cut from the Fire's original price when it launched in July.

Amazon has been having difficulties selling the phone. Last quarter, it took a $170 million charge for the phone and vowed to undergo more drastic strategies to unload its inventory.

RW Note: I have seen the phone at the Amazon store at the Wakefield Mall in San Francisco and it looks good to me, and it has the Mayday feature, which allows an Amazon customer service rep to appear on screen and help you with any problems.

The one problem will be with any future apps. Since the phone isn't selling, app producers won't be spending time developing apps specifically for the phone, but it appears most current apps do have Fire phone versions.

Amazon has been having difficulties selling the phone. Last quarter, it took a $170 million charge for the phone and vowed to undergo more drastic strategies to unload its inventory.

RW Note: I have seen the phone at the Amazon store at the Wakefield Mall in San Francisco and it looks good to me, and it has the Mayday feature, which allows an Amazon customer service rep to appear on screen and help you with any problems.

The one problem will be with any future apps. Since the phone isn't selling, app producers won't be spending time developing apps specifically for the phone, but it appears most current apps do have Fire phone versions.

Housing Price to Rent Ratio

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price (monthly cost to own)-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Calculated Risk has taken that formul a and developeda similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2003 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to May 2003. However, all remain far below the peaks in the ratios during the housing bubble.

9

Calculated Risk has taken that formul a and developeda similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2003 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to May 2003. However, all remain far below the peaks in the ratios during the housing bubble.

9

David Stockman: Why Crony Capitalism Will Be Hard To Uproot

Interview Of David Stockman By Henry Bonner at Sprott Global

Ronald Reagan and David Stockman

David Stockman was elected to Congress at age 29 back in 1976; he was an avid student of Austrian economics and supported a gold-backed money system and a balanced budget. He later joined the Reagan administration as Budget Chief, where he watched in awe as the Reagan administration quickly became the most profligate spenders in the history of the United States.

After leaving the Reagan Cabinet, he worked at the well-known investment house Salomon Brothers, and later co-founded the Blackstone Group alongside legendary hedge-fund manager Steve Schwarzmann.

In his most recent book, The Great Deformation: The Corruption of Capitalism in America, Stockman systematically repudiates and dismantles the myths surrounding the Fed’s supposed past successes at helping the US economy avoid major breakdowns, going all the way back to the crash of ‘29. Instead, as he explains, “Programs born out of desperation or idealism 75 years ago have ended up as fiscal time bombs like Social Security or as captive fiefdoms of one crony capitalist syndicate or another… Policies undertaken in the name of public good inexorably become captured by special interests and crony capitalists.”

The most important lesson I took from the book and the interview? Remember that there has never been a time of such profound debt saturation, coupled with intense crony capitalism, as today. No one has ever been here to tell how it turns out. We truly are in an unprecedented era…

David, can you explain how the ‘Fed put’ works on the stock markets and bond markets? How exactly does it translate into artificially higher stock prices and lower interest rates?

Tuesday, November 25, 2014

The People's Republic of San Francisco is Now Micro-Managing Employee Schedules of Chain Stores

San Francisco is now the country’s first jurisdiction to limit how chain stores can alter their employees’ schedules.

San Francisco’s new law, which its Board of Supervisors passed Tuesday by unanimous vote, will require any “formula retailer” (retail chain) with 20 or more locations worldwide that employs 20 or more people within the city to provide two weeks’ advance notice for any change in a worker’s schedule. An employer that alters working hours without two weeks’ notice — or fails to notify workers two weeks ahead of time that their schedules won’t change — will be required to provide additional “predictability pay.“ Property service contractors that provide janitorial or security services for these retailers will also need to abide by the new rule, reports the San Francisco Chronicle.

In other words, the city will now make it more cumbersome for retailers to adjust to short-term changing conditions like weather or other unexpected events.

In addition to limiting schedule changes, the bill requires employers to pay part-time employees the same starting hourly wage as full-time employees in the same position. Employers must also give part-time employees the same access to time off enjoyed by full-time workers, and equal eligibility for promotion.

What can I say? Harass employers and the robots will continue to come. SEE: Venture Capital is Pouring Money into Minimum Wage Law Defeating Robots

San Francisco’s new law, which its Board of Supervisors passed Tuesday by unanimous vote, will require any “formula retailer” (retail chain) with 20 or more locations worldwide that employs 20 or more people within the city to provide two weeks’ advance notice for any change in a worker’s schedule. An employer that alters working hours without two weeks’ notice — or fails to notify workers two weeks ahead of time that their schedules won’t change — will be required to provide additional “predictability pay.“ Property service contractors that provide janitorial or security services for these retailers will also need to abide by the new rule, reports the San Francisco Chronicle.

In other words, the city will now make it more cumbersome for retailers to adjust to short-term changing conditions like weather or other unexpected events.

In addition to limiting schedule changes, the bill requires employers to pay part-time employees the same starting hourly wage as full-time employees in the same position. Employers must also give part-time employees the same access to time off enjoyed by full-time workers, and equal eligibility for promotion.

What can I say? Harass employers and the robots will continue to come. SEE: Venture Capital is Pouring Money into Minimum Wage Law Defeating Robots

Is Milton Friedman the Direct Cause of the Current Crazed Fed "Inflation Targeting"?

By Robert Wenzel

I have been trying to trace back where this crazed notion, that there should be a "target inflation" rate, developed.

I have been trying to trace back where this crazed notion, that there should be a "target inflation" rate, developed.

For sure. it launched as policy at the Federal Reserve under Fed chairmanship of Ben Bernanke. He even edited a book, Inflation Targeting: Lessons from the International Experience. I find no record of Alan Greenspan advocating inflation targeting while he was Fed chairman.

In fact, he argued against it:

Federal Reserve Chairman Alan Greenspan rejected the idea of using an inflation target to set U.S. interest rates, saying it is ``highly doubtful'' such a policy would improve policy making.

The U.S. economy is too complex to reduce monetary policy to a rule-based model, Greenspan told a Kansas City Fed conference in Jackson Hole, Wyoming.

But where did this idea originally come from that there should be an inflation target in the first place?

In his book, IMF Essays from a Time of Crisis: The International Financial System, Stabilization, and Development, current Fed vice chairman Stanley Fischer suggests that it occurred as a riff off of Milton Friedman's monetary rule and his erroneous notion of a tradeoff between inflation and output:

In the 1950s, Milton Friedman made the case for the use of a simple money-growth rule...The nature of the tradeoff between inflation and output was clarified in the 1960s, with one of the key contributions here also being Friedman, along with Edmund Phelps...As these developments were absorbed into economics, the case for the inflation targeting approach to monetary policy clarified.Murray Rothbard knew way back that Friedman's theories (and those of his Chicago School predecessor, Irving Fisher) were trouble. In 1971, he wrote:

[T]he key problem with Friedman’s Fisherine approach is the same orthodox separation of the micro and macro spheres that played havoc with his views on taxation. For Fisher believed, again, that on the one hand there is a world of individual prices determined by supply and demand, but on the other hand there is an aggregate "price level" determined by the supply of money and its velocity of turnover, and never the twain do meet. The aggregate, macro, sphere is supposed to be the fit subject of government planning and manipulation, again supposedly without affecting or interfering with the micro area of individual prices.And so now we have a Fed that has upped the madness, not only must policy aim at preventing prices from falling, as was the policy under the Fisher influenced Fed, but with the introduction of new macro-tinkering ideas developed by Friedman, the Fed now has a target positive inflation rate---that completely ignores the distortions such a policy causes at the fundamental business cycle level (SEE: Austrian School Business Cycle Theory). And ignores the benefits of naturally falling prices. Further, the Fed is completely oblivious to the fact that price inflation does not have to continue along the current slow trend line. A point I warn about in the EPJ Daily Alert and a point that Greenspan now seems willing to admit. Just recently, he said:

Fisher on Money

In keeping with this outlook, Irving Fisher wrote a famous article in 1923, "The Business Cycle Largely a ‘Dance of the Dollar’ " – recently cited favorably by Friedman – which set the model for the Chicagoite "purely monetary" theory of the business cycle. In this simplistic view, the business cycle is supposed to be merely a "dance," in other words, an essentially random and causally unconnected series of ups and downs in the "price level." The business cycle, in short, is random and needless variations in the aggregate level of prices. Therefore, since the free market gives rise to this random "dance," the cure for the business cycle is for the government to take measures to stabilize the price level, to keep that level constant. This became the aim of the Chicago School of the 1930s, and remains Milton Friedman’s goal as well.

Why is a stable price level supposed to be an ethical idea, to be attained even by the use of governmental coercion? The Friedmanites simply take the goal as self-evident and scarcely in need of reasoned argument. But Fisher’s original groundwork was a total misunderstanding of the nature of money, and of the names of various currency units. In reality, as most nineteenth century economists knew full well, these names (dollar, pound, franc, etc.) were not somehow realities in themselves, but were simply names for units of weight of gold or silver. It was these commodities, arising in the free market, that were the genuine moneys; the names, and the paper money and bank money, were simply claims for payment in gold or silver. But Irving Fisher refused to recognize the true nature of money, or the proper function of the gold standard, or the name of a currency as a unit of weight in gold. Instead, he held these names of paper money substitutes issued by the various governments to be absolute, to be money. The function of this "money" was to "measure" values. Therefore, Fisher deemed it necessary to keep the purchasing power of currency, or the price level, constant.

This quixotic goal of a stable price level contrasts with the nineteenth-century economic view – and with the subsequent Austrian School. They hailed the results of the unhampered market, of laissez faire capitalism, in invariably bringing about a steadily falling price level. For without the intervention of government, productivity and the supply of goods tends always to increase, causing a decline in prices. Thus, in the first half of the nineteenth century – the "Industrial Revolution" – prices tended to fall steadily, thus raising the real wage rates even without an increase of wages in money terms. We can see this steady price decline bringing the benefits of higher living standards to all consumers, in such examples as TV sets falling from $2000 when first put on the market to about $100 for a far better set. And this in a period of galloping inflation.

It was Irving Fisher, his doctrines, and his influence, which was in large part responsible for the disastrous inflationary policies of the Federal Reserve System during the 1920s, and therefore for the subsequent holocaust of 1929. One of the major aims of Benjamin Strong, head of the Federal Reserve Bank (Fed) of New York and virtual dictator of the Fed during the 1920s, was, under the influence of the Fisher doctrine, to keep the price level constant. And since wholesale prices were either constant or actually falling during the 1920s, Fisher, Strong, and the rest of the economic Establishment refused to recognize that an inflationary problem even existed. So, as a result, Strong, Fisher, and the Fed refused to heed the warnings of such heterodox economists as Ludwig von Mises and H. Parker Willis during the 1920s that the unsound bank credit inflation was leading to an inevitable economic collapse.

So pig-headed were these worthies that, as late as 1930, Fisher, in his swansong as economic prophet, wrote that there was no depression, and that the stock market collapse was only temporary.

Ultimately, inflation will eventually rise. It has to rise...The current inflation target policies at the Fed are ignoring many fundamentals that Friedman obscured with his incorrect monetary theories and it is likely to result in extreme volatility in the economy and price inflation in the not too distant future.

Robert Wenzel is Editor & Publisher at EconomicPolicyJournal.com and at Target Liberty. He is also author of The Fed Flunks: My Speech at the New York Federal Reserve Bank. Follow him on twitter:@wenzeleconomics

Venture Capital is Pouring Money into Minimum Wage Law Defeating Robots

Venture capitalists poured $172 million into robotics startups last year, according to an annual survey by PricewaterhouseCoopers LLP—nearly triple the $60 million two years earlier.

WSJ reports:

Be sure to watch this video:

WSJ reports:

In the past, robots worked mostly on factory floors—often locked behind gates to keep them from smashing into people as they did their jobs. But new technologies, including sensors and wireless connections that allow robots to move around obstructions and even find their way around a busy hotel or office, have enabled robots to do more varied tasks as well as function alongside people.Some of this funding might have occurred without new higher minimum wages, but for certain many businesses are looking at robots as a way to counter the cost of hiring a high cost minimum wage employee.

Steve Cousins, chief executive and founder of Savioke in Santa Clara, Calif., says he saw a shift in sentiment among venture capitalists. “It was hard to find VC funding for robotics three years ago,” he says. “You had a lot of people who said, ‘We don’t do hardware, we do software.’”

Mr. Cousins’ company builds a robotic butler that hotels can use to shuttle items to guest rooms. It’s currently operating in one hotel in California but a host of other companies have expressed interest in the machines, Mr. Cousins says. Savioke raised $2.6 million earlier this year, above the target of $1.75 million to $2.5 million.

“For a long time, robots stopped at factories—and they were behind cages,” Mr. Cousins says. But much of the new investment is going into machines that are designed to operate close to people, like his hotel robot.

Be sure to watch this video:

It Has Only Begun: Nearly 120 Protests over Ferguson Decision Planned

As of midday, nearly 120 protests were planned for Tuesday (mostly at night) in 35 U.S. states, Washington, D.C. and Canada, according to information from a site set up to help organize the efforts, the Ferguson Response Network.

Like most revolutions, this rage and the rioting will not change anything. The protesters have no clue as to underlying problems. Some are opportunists who don't care and just want to loot, and some have rage but incorrectly believe that gaining control of the power structure is the solution. They mix and confuse government power with private sector corporations that serve consumers, and they believe they are one in the same. And, further, they think that the front men of government need to be changed with different front men, when it is government and its destructive nature that must be shrunk--not changed.

The LOUP must be freed of minimum wage laws, compulsory education and charlatans like Al Sharpton and Jesse Jackson, before there is a chance for improvement.

Minimum wage laws keep these hoodlums on the streets and blocks them from getting their first job experiences. Compulsory government education is obviously worthless.

The government can't educate these hoods and they can't protect us from their vandalism. What we are seeing in these riots is the intersection of government failures.

(via CNN)

Like most revolutions, this rage and the rioting will not change anything. The protesters have no clue as to underlying problems. Some are opportunists who don't care and just want to loot, and some have rage but incorrectly believe that gaining control of the power structure is the solution. They mix and confuse government power with private sector corporations that serve consumers, and they believe they are one in the same. And, further, they think that the front men of government need to be changed with different front men, when it is government and its destructive nature that must be shrunk--not changed.

The LOUP must be freed of minimum wage laws, compulsory education and charlatans like Al Sharpton and Jesse Jackson, before there is a chance for improvement.

Minimum wage laws keep these hoodlums on the streets and blocks them from getting their first job experiences. Compulsory government education is obviously worthless.

The government can't educate these hoods and they can't protect us from their vandalism. What we are seeing in these riots is the intersection of government failures.

(via CNN)

Subscribe to:

Posts (Atom)